There is a secret toolbox that exists in the sagacious financial mind and one of those tools is a little something I like to call debt laundering. What is debt laundering?

Debt laundering is the process of taking bad debt (like student loans) and exchanging it for good debt (like credit card debt).

I know what you’re thinking…”Isn’t credit card debt as bad or worse than student loan debt?” Well the answer is always going to be: it depends. But here are a few things to consider:

- Student loan debt, with very few exceptions, is not dis-chargeable in bankruptcy even after some changes by the Biden administration..

- Student loan debt, until paid off, will follow you to your grave.

- Student loan debt may result in your social security income being garnished to pay off those loans.

- Student loan debt may keep you from buying a home, getting a car loan or other loans.

As you can see from the list, student loans are pretty bad and can get you into a world of hurt for years or decades so I think of it as the worst kind of debt. At one point, I had about $20k in student loan debt at 7% interest rate and I couldn’t wait to get that albatross of my back so here’s how I did it.

Credit Card Balance Transfer

After I finished college and had to start paying back my student loans, I received an offer from a credit card that I had for a 0% balance transfer for 12 months. The offer had a nominal fee for the balance transfer but the interest rate would be 0% so I jumped at the chance and transferred $5000 of the $20k.

While my loan situation was decades ago, I did some math to see how it would work today. Using Bankrate.com calculator I came up with this scenario.

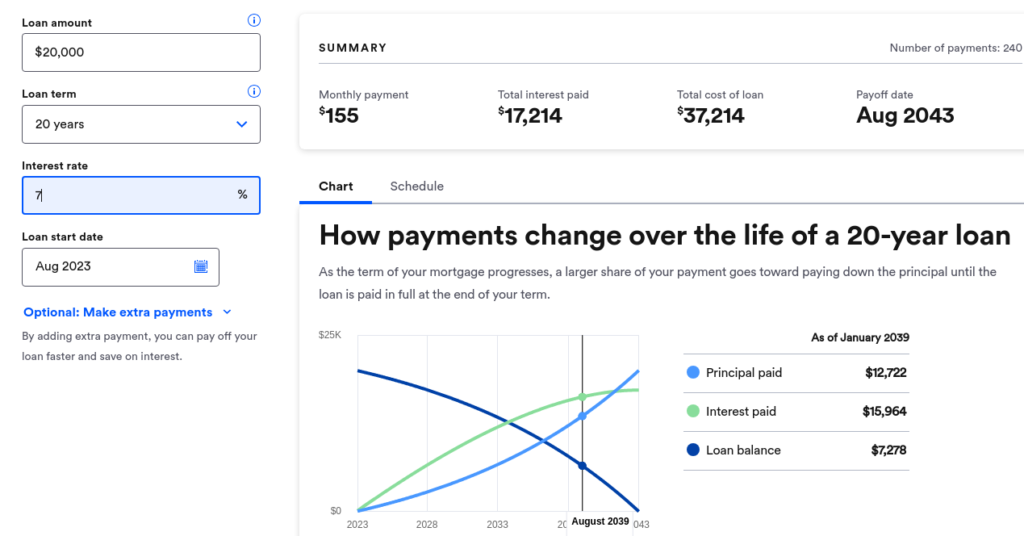

A loan of $20k at 7% interest rate would end up costing $37,214 over 20 years with a monthly payment of $155. Total interest paid will be $17,214. But by balance transferring $5000 off at zero percent we get this new loan outlook.

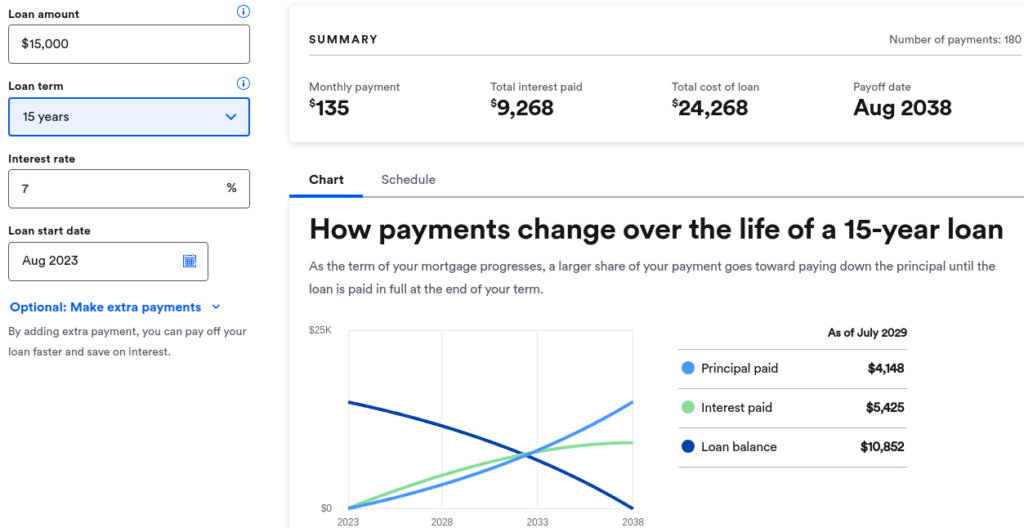

The new $15k loan now only has a total cost of $24,268, total interest of $9268 and a lower monthly payment of $135. By using a 0% balance transfer the total cost of the loan has gone down by ($37,214-$24,268=$12,946), $13k!

What about the credit card and the $5,000? Well $5,000 / 12 = $417/month and you can’t be late or miss a payment or the interest rate will default to the high rate of 20% or more so what I did is send in weekly payments of $104. If you’re not good at keeping up with payments or financially disaster prone, this may not be the best option for you even though it saves a ton of money. The best part of the credit card transfer though is that in a worst-case-scenario and you’re not able to make credit card payments, the credit card debt IS dis-chargeable in bankruptcy in the event that happens and the debt is gone forever!

Low Interest Rate Loan (Credit Union)

The credit card balance transfer isn’t where my student loan saga ended. I had an account at a credit union which offered something called a share loan. What is a share loan? Essentially it is money you lend yourself so if you deposit $10k into your saving account, you can borrow $10k at a very low interest rate of 2% or 3%. I know what you’re going to ask…”If you have $10k why not just pay off the loan?”

The answer to that question is simple: I wanted to build more credit to eventually buy a house and having a credit card balance and a credit union loan and consistently paying them off would demonstrate credit worthiness and boost my credit score.

Through a combination of balance transfers and share loans, I’ve managed to pay off cars, houses, and of course student loans but there are other options.

Home Equity Loan

If you own a home, it may be worth it to look into getting a home equity loan to pay off those student loans. While bankruptcy laws vary state to state, a home is usually exempt from bankruptcy proceedings in worst-case-scenario situations. I was fortunate enough to take out a home equity loan recently at 4 percent and I took that money and invested in bonds paying 5.5 percent today. It’s a small amount of profit but once again I am boosting my credit scores and earning a profit.

Friends & Family

As a long shot asking friends and family for help with student loans can be a godsend. Depending on how much you owe, it may take one or more of the things I listed here to get you out of student loan hell but as Winston Churchill is attributed to saying,” if you are going through hell keep going.”