I am in the market for a new home but the home is not for me, it’s for one of my kids. My kid has been renting for the past two years and it pains me to see him throw money away each month. What I mean by “throw away” is that he isn’t building equity in an asset he can use later as a rental property or a trade up onto a better property so I decided I’m going to help him out but first we need to wait for mortgage rates to go sky high.

Yes, you read that right, we are waiting for mortgage rates to go higher!

Higher Mortgage Rates Means Lower Capital Costs

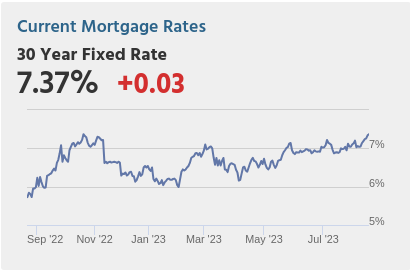

The image below is from Mortgage News Daily, which is a popular website for mortgage news.

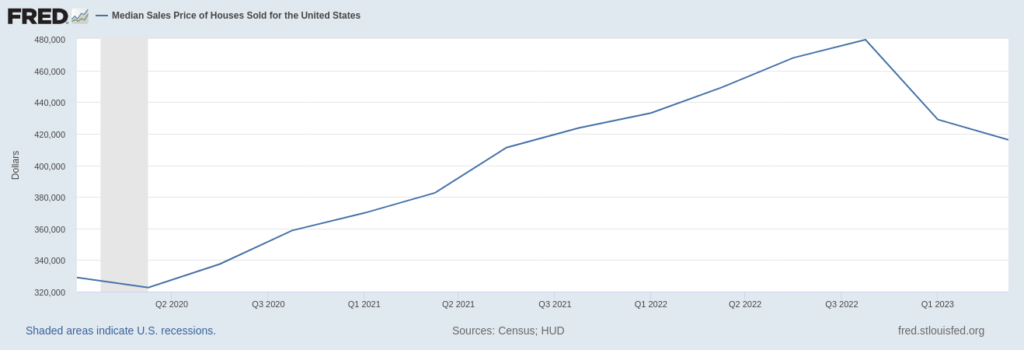

The chart below is from the St. Louis Fed which shows the median price of a home from 2020 thru 2023.

As mortgage rates have climbed, it has made home affordability more difficult and as a result, home prices have been going down. I’m sure home prices haven’t changed or perhaps gone up in some areas but the median price and trend has been down, on average, nationally.

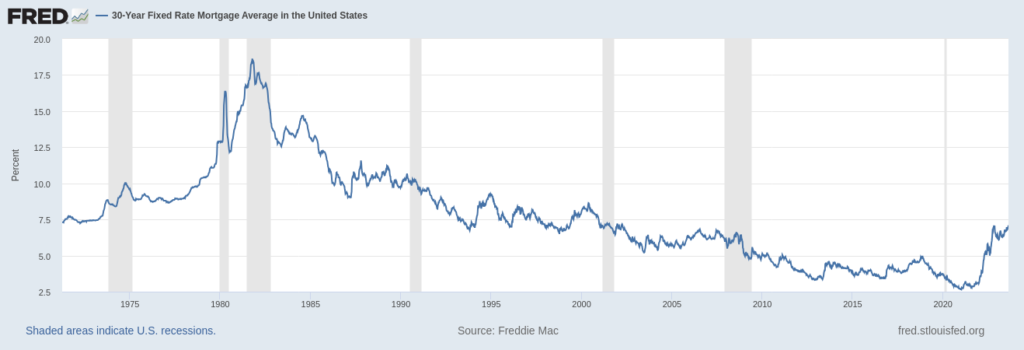

I bought my first home at 7.5% interest rate in the late 90s and that rate was perfectly normal back then but now people seem to have become accustomed to having mortgage rates in the 3 percent or less range and are “waiting” for rates to go back down and I hope that doesn’t happen but it’s unlikely anyway.

I downloaded data from the St. Louis Fed for mortgage rates from April 1971 to August 2023 and the average rate of 30 year mortgages for that time frame is 7.74 percent.

Home Buying Strategy

My plan is to wait for two key things to happen before I even think about buying a home.

- Mortgage rates need to peak

- Home prices for the area I want to buy need to correct by at least 15% or more.

Until those two conditions happen, it won’t be a good time to buy. Buying at peak mortgage rate means rates will likely go down (hence the peak) and I’ll be able to refinance at a lower rate in a few years.

Home Buying Valuation

For me, the most important thing about buying an asset is to make sure the initial capital cost is within reason and I will determine that with one of three methods:

- Use an inflation adjusted cost for the home based on nominal values from pre-covid time. Example: If a home was worth $300,000 in 2018 and it’s priced at $500,000 in 2023 then I know that home is over priced. The BLS has an inflation calculator here. I put $300,000 and 2018 and then calculated what that should be in 2023 and out came $370,000.

- Use the 1% rule (rental rates). The second way to determine the value of a home (asset) are the discounted cash flows that could come from the asset. For example, if a three bedroom, two bath home in an area will rent for $2500/month then the house, in theory, should be worth $250,000. The calculation is $2500/0.01 = $250,000. Some markets may have higher rental rates and the 1% rule won’t work but the percentage can be tweaked as long as it is consistent for the market.

- Use historical & current comparisons – most realtors will run “comps” to compare houses in a given neighborhood and give you and idea if the selling price is warranted. I use this method the least and only incorporate it to validate 1 & 2 above. I don’t like this because the numbers usually come from realtors and their primary interest is making as high a commission as possible and that usually means getting the highest price report possible.

What about hot markets, population changes, demand, supply, etc? Well all those things play a factor and if you want to emotionally convince yourself of something you can find lots of buzzwords to rationalize a purchase but I prefer to let the math do the analysis and talking so I can make a final sound financial decision.

Home After Life Strategy

Do you believe in an after life? Well if you don’t you should be aware that your home will have an after life. At some point, it is likely that you will either:

- Sell the home and move to another home.

- Move to another home and rent out the existing home.

- Depart this world and leave your home to someone.

There is a fourth option which I don’t recommend and that’s move to another home and leave your old home vacant. I highly recommend that you don’t leave your old home sitting idle. A busted water pipe or criminals squatting in your home can make for a very costly lesson in vacant housing. At a bare minimum, you should consider getting a house sitting service or property manager to periodically check in on your vacant house.

Before you purchase that new home, be sure to have a plan for that home’s afterlife because having an exit strategy or investment plan for rental properties will make things a whole lot easier when you’re ready to move on.