Everyone should have a diversified investment portfolio and the general recommendation is to have a 60/40 of equities/bonds but I prefer to really diversify my portfolio which includes other things but today I’m going to talk about my bond portfolio.

For the past 15 years, bonds were paying virtually nothing in terms of interest because the Federal Reserve had interest rates set close to zero. And for 15 years, I ignored bonds because they were overpriced and paid little to no interest. All of that changed last year when the Fed started hiking interest rates by 525% and here we are today with bond prices crashing and yields soaring. Let’s take a look at what I hope to achieve with my diversified bond portfolio.

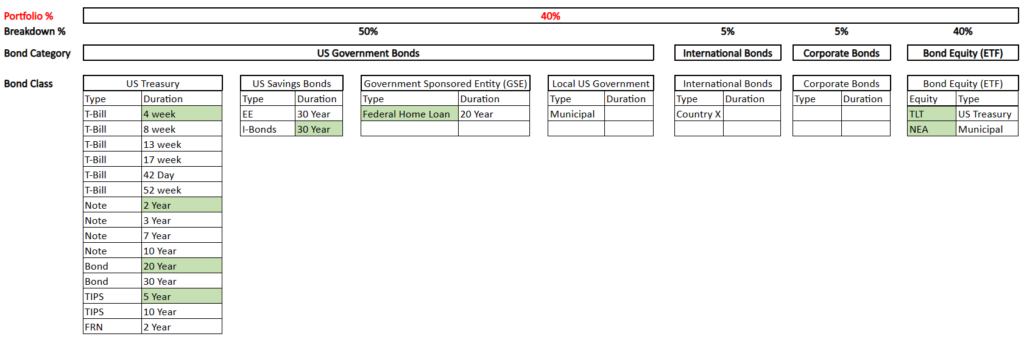

Bond Portfolio Map

First, I want my bond portfolio to make up about 40% of my total investment portfolio. Second, I want the breakdown of my bond portfolio to include 50% US Government Bonds, 40% Bond Equity ETFs, 5% International Bonds and 5% Corporate Bonds. Third, I want diversification across time.

US Government Bonds

I want at least half (50%) of the heavy bond load in my portfolio to include US Government Bonds and the items colored green in the map indicate items currently in my portfolio which includes T-Bills, Notes, and Bonds. I have diversified them across time with short-term, mid-term and long term holdings. Why go heavy with US Government Bonds? Because they are backed by the taxpayer and if the US Government defaults on bonds then the world will be coming to an end and there’s no need to worry about anything.

US Savings Bonds

At one point, I-Bonds were paying close to 10% last year when inflation was high and I loaded up on these by buying the max limit. I still have I-bonds but I may move money out of there in the near future and re-allocate. I doubt I will ever buy EE bonds.

GSE Bonds (Government Sponsored Entities)

I found a GSE bonds while browsing through bonds the other day that was paying 7 percent so I decided to buy some but it is callable so this time next year I may get my money back if interest rates suddenly fall. If interest rates rise, they’ll likely keep paying 7 percent. This is a 20 year bond.

Municipal Bonds

The point of municipal bonds in my portfolio is to earn tax free income as these bonds are exempt from state and federal income taxes so they should be in a taxable account like a brokerage cash account. While I don’t own any municipal bonds at the moment, I do own a municipal bond etf which I have on DRIP (Dividend Reinvestment Program) to grow in a taxable brokerage account.

International Bonds

The US Government isn’t the only government in the world that sells bonds and while I don’t have any yet, I am researching some prospects. It’s not a priority for me right now as I only plan on holding at most, 5 percent in my portfolio.

Corporate Bonds

Corporate bonds are starting to offer some juicy yields but I’m still waiting for yields to go higher before I buy and since this will only make up 5% of my portfolio, I’m not in a hurry to fill it.

Bond Equity ETFs

Bond ETFs will be the second largest part of my portfolio at 40% and the primary reason for this is because many bond ETFs offer the ability to trade options. I am able to buy/sell calls or put on these ETFs to squeeze more money out of them or to protect from down slides. Right now, I have a position on TLT which has been rising nicely this week and I am tempted to sell calls to juice it even more but I’m going to hold and let it ride. As mentioned earlier, I also have NEA in a cash taxable account.

The Future

If all goes well, I hope to be counting my money like the man depicted in the photo below!