With the end of the calendar year comes lots of goodies and one of my favorite things to do is to see how much and where I spent my money. Today, I am going to cover how I spent $95,000 on two of my favorite travel cards and it ties into this post entitled, “How a Millionaire Uses Credit Cards.“

The Spend

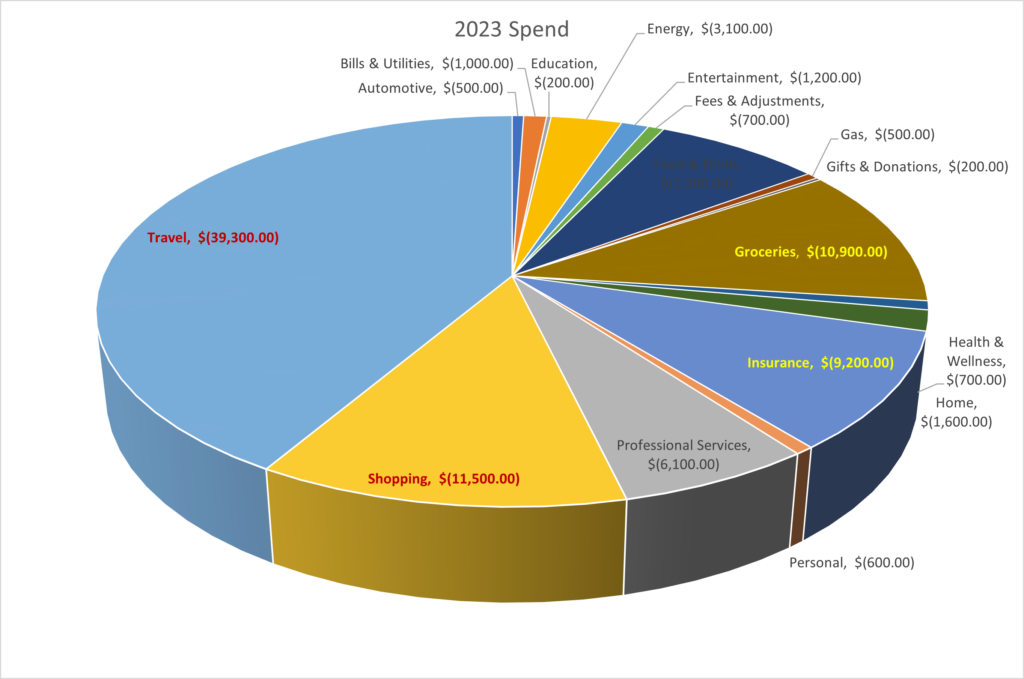

The table below shows how much I spent on some categories. Keep in mind that these are just two credit cards that are geared towards travel. One is an airline card and the other is a hotel branded credit card but I combined the two to simplify the math. I also rounded to the nearest hundred to make everything look simpler and cleaner.

| Category | Total Spend |

|---|---|

| Automotive | 500 |

| Bills & Utilities | 1000 |

| Education | 200 |

| Energy | 3100 |

| Entertainment | 1200 |

| Fees & Adjustments | 700 |

| Food & Drink | 7300 |

| Gas | 500 |

| Gifts & Donations | 200 |

| Groceries | 10900 |

| Health & Wellness | 700 |

| Home | 1600 |

| Insurance | 9200 |

| Personal | 600 |

| Professional Services | 6100 |

| Shopping | 11500 |

| Travel | 39300 |

| Total | 94600 |

Here is a PIE chart. The largest spend went to Travel, Shopping, Groceries and Insurance categories. These four categories accounted for about $71,000 of spend.

The Top Four Categories

As I mentioned, this is spend on two travel credit cards so it shouldn’t be a surprise that there is nearly $40k of travel on them. Where did we go? Hawaii, Europe, and U.S.

What did surprise me is how much Insurance has gone up. Our home owners insurance went up $1000 this year and auto insurance has gone up and ironically I don’t even drive a car!

Our grocery bill runs about $1000/month evidently and I need to look at bringing this down in 2024. Inflation had a lot to do with the high cost and we do buy groceries when we travel to lower the eating out costs when we can.

The Benefits

So I charged $95k what are the possible benefits? Using a 2% cash back card, I could have earned about $1,900 in cash back rewards. Using an airline credit card, I could have earned 95,000 frequent flier miles or 95,000 hotel points. So what’s the best option?

The answer to that question is going to be, it depends. It depends on what is important to YOU. I know people that play the credit card game and for some it is important that they earn “elite” status on airlines so they can get some perks like boarding first or possibly being upgraded to business/first cabin. I confess that when I was younger, I liked being an elite airline travel member but I don’t care about that anymore because the most time I’ve ever spent on a plane was 18 hours flying from Texas to Australia. Additionally, I also just buy a business class seat when they are on sale so I don’t ever have to hope for a free upgrade.

My preference with travel credit card, at the moment, are hotel “elite” status for a variety of reasons. First, when I go on vacation, I WILL be spending many days in a hotel room whereas I’ll only spend a few hours on a plane. Second, hotel upgrades for “elites” can be very rewarding. On that trip to Australia, I was upgraded to a penthouse suite with my hotel credit card and elite status for the entire time I was there. Third, the hotel brand I stay with offers “elites” lounge access which often includes alcohol, free food and/or snacks. Fourth, I often stay free by using points to book hotel stays. I once took my family and got a free week in Europe redeeming my hotel points. Fifth, points are exchangeable to other programs such as airline miles, shopping or charity.

What about just pocketing the $1900? Well if you’re not a big traveler and have other priorities then perhaps cash is the best route for you. I travel a great deal every year and I’d rather have the hotel perks I listed than $1900 in cash. The perks themselves are often worth far beyond the cash back but it’s up to every person to make that decision for themselves.

I’ve got a few trips planned for this year and will be off to Europe soon enough.

1 thought on “How I Charged $95,000 On Two Credit Cards In 2023”

Comments are closed.