There isn’t a week that goes by that someone asks for personal financial advice. The problem with giving personal financial advice is that in order to give truly useful advice you need to know a whole lot about the person.

This week someone asked me how I became so wealthy and what they could do to do the same. I explained to this person that when I was in my late teens and early 20’s I mapped out my career path and outlined all the things I needed to accomplish to make that plan happen. Getting wealthy was a side effect of building my professional work career.

I built my career on moving from position to position and soaked up as much professional level experience I could. I told my employers what I wanted to do and asked for training in those specific areas. Throughout this time I also started saving and investing money.

I asked this person what they were doing in their late teens and early 20’s and the response was “getting pregnant” and struggling my way through it. That answer alone explained a whole lot about her current situation, she now has three kids, a house and husband but little retirement savings and now is in her mid 30s.

But the little information provided still doesn’t tell me what I need to know. How much is their total household income? what are their total expenses? what are the plans for their kids education? What future prospects do they think they have financially? What about career prospects? What is their motivation level? Ambition? What is holding them back?

I could go on but that’s just a sample of questions that need to be asked and answered in order to build a complete picture. In a post, “My Personal Financial Operating Manual” I outlined many of the things that need to be thought through to build a framework for current and future financial prospects.

Unfortunately, when I started to get into all this detail with my friend she replied that it’s too complicated and too time consuming to go over all of this and that’s exactly my point right now. Learning and doing all of these things doesn’t happen overnight, it took me a good solid decade to build a framework that I’m happy with and I still tweak it today decades later.

Ultimately, I think the best advice I can give anyone that needs help is to learn about personal finance. Start small with the basics about money management, then investing then risk management strategies.

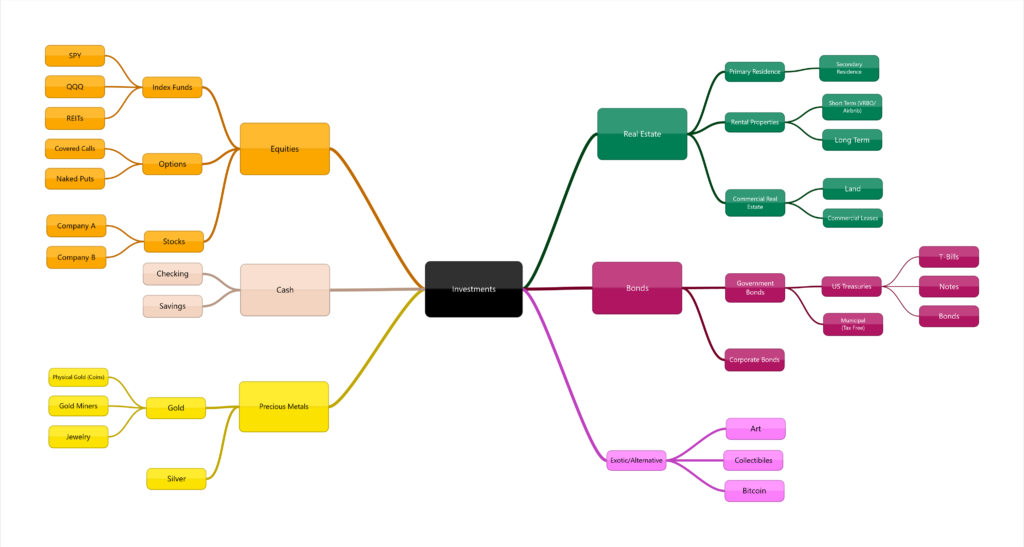

This is what my investment portfolio looks like right now after 30 years of saving and investing. At the beginning there was only one box -> Cash. The Cash box grew to checking and saving accounts then equities, real estate, bonds, precious metals, etc.

I had a list of books that I used to recommend but honestly there are so many resources on YouTube, the web, blogs, and other places online and most are free that paying for books seems like a waste of money.

I have added a Resources page on this site to help my friend and others find some simple resources to get started and hopefully grow their knowledge from there. I haven’t finished putting all the links together but I will continue to work on it when I have time.