The greatest thing about investing in the United States are the endless choices. The worst thing about investing in the United States are the endless choices. From tens of thousands of stocks to even more bonds and seemingly endless real estate there are just too many choices and too many decisions to make so how do you filter through it all?

Data Sets

One of the things I have learned over the years is to start a collection of data sets for a variety of things. Whenever I run across some good data sets I make it appoint to add it to my library that I store on the cloud so I can reference it in the future. Not only that but I actually take the data and create my own charts, graphs or other annotations for my reference.

This brings me to municipal bonds. I’m not going to go into describing what they are or how they work because that’s something anyone can read online or do a google search to figure out how they work. The key thing about municipal bonds is that the interest they pay is usually exempt from federal income taxes but the interest still counts against your IRMAA.

Which Bonds To Avoid?

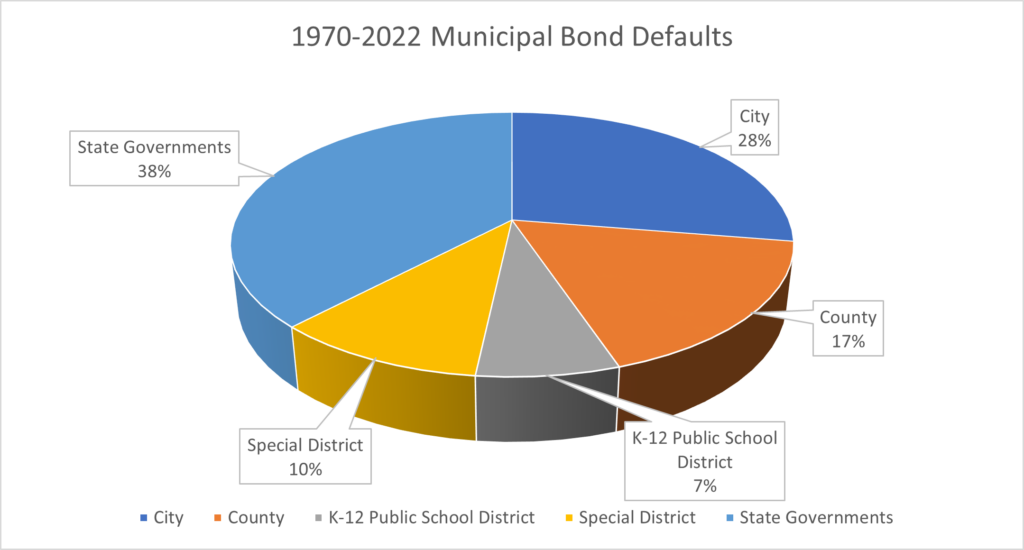

In doing my research about which munis I may want to buy I came across this great article which summarized municipal bond defaults from 1970 to 2022. I took the data and created these summary charts which I can now easily reference on my blog when I’m thinking of buying some munis.

The chart above shows that if you want to buy bonds then the type that default the least are K-12 Public School District, Special District or County bonds.

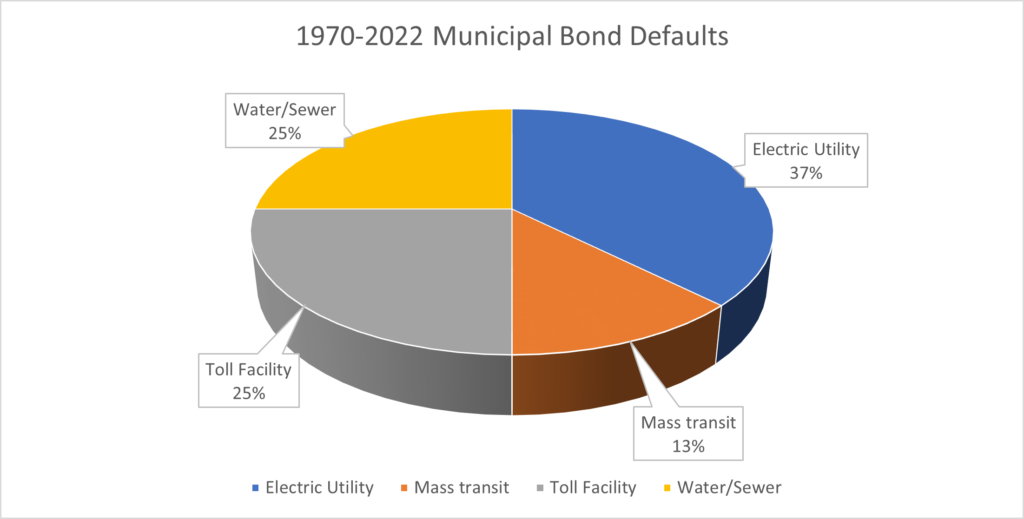

Slicing and dicing the data a different way, the munis to AVOID first are electric utility as they have the highest share of defaults between utility types.

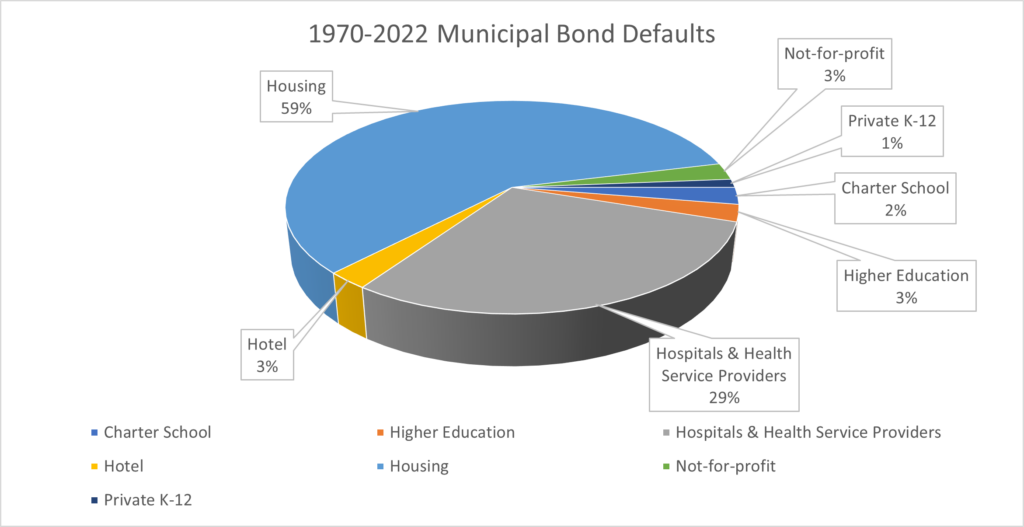

Last, looking through enterprise types, it is best to avoid housing and hospital/health service providers municipal bonds at all costs!

What about ratings?

Ratings matter the most and it should be obvious that AAA rated bonds will have the least amount of defaults while anything below B is asking for trouble.

What To Buy?

It would seem that special district, school district or county municipal bonds that are raising funds for transit or schools are the best bet. Logically, this seems to make sense as people love cars and kids and adults need continuous education so there will always be demand for those two things.

What Not To Buy?

I was surprised by electric utility high defaults since everyone uses electricity every day but electric utilities do get blamed for things like forest fires as noted here in California and here in Hawaii so they clearly have a higher risk than toll roads or transit bonds.

And just this week, I got notified from Fidelity about a few municipal bonds with juicy yields but guess what type they were!

These municipal bonds have juicy yields of 5.885 percent or 7.847 percent tax equivalent yield according the Bankrate Tax Equivalent Yield Calculator. But with nearly 60% of these types of bonds defaulting historically, NO THANKS.

I hope you found this useful and add it to your investment library because I know I will and that’s that.