I have separated my money into three buckets as I wrote about here and after some research, I’m coming close to determining the best way to invest the money in these buckets. Keep in mind that the money in all of these buckets is already invested but after doing some serious planning for retirement, I’ve realized that my buckets are filled with the wrong investments. Why? Taxes and tax brackets!

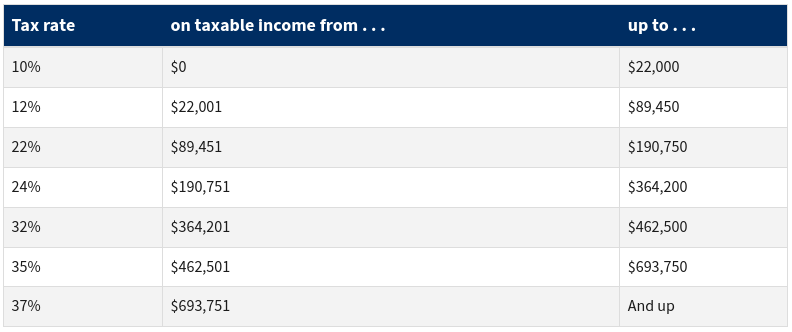

Tax Brackets

The image below has the 2024 tax brackets for a married couple filing jointly. These will be important later but know that my wife and I move between 24% to 35% depending on how well our employer companies did, bonus and stock payouts, and investment returns.

Taxable Bucket

My first money bucket is the “taxable” bucket. This is simply a bucket that holds money that, when invested, is fully taxable. What kind of accounts are inside this bucket? Checking Accounts, Savings Accounts, Certificate of Deposits, Treasury Bonds, and Taxable Brokerage Accounts. The investment returns these buckets generate will be taxed as either interest, dividends, or capital gains.

Taxes On Interest

The tax rate on interest is that of ordinary income so if I my wife and I are earning $364,000 as part of our job salaries we are at the 24% tax bracket. If however we have $5000 in interest from a CD then that gets added to our $364,000 to make it $369,000 which now puts us into the 32% tax bracket for that extra income. The $5000 will be taxed at 32% and any income after the $5000 will be taxed at 32%…ouch!

Taxes on Dividends

Taxation on dividends is a little more complicated. There are two types of dividends, qualified and non-qualified. The qualified dividends will have a tax rate of anywhere between 0% to 20% depending on income level. You can read about the details here.

Right off the bat, you can easily tell that the highest tax rate for dividends is 20% which is far better than the 32% bracket for earned interest. It is easy to see that in a taxable account, I am better off with an investment that pays dividends instead of interest but can we do better?

Taxes on Capital Gains

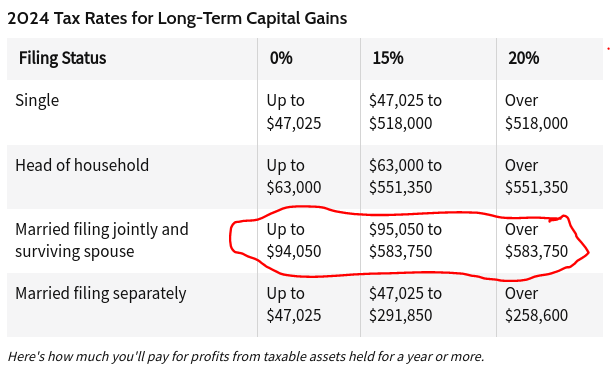

Taxes on capital gains are even better than dividends because there is a special table for capital gains taxes as shown in the image below for 2024.

When it comes to capital gains our income would need to be over $583,750 to push up into the 20% tax bracket. But the whole situation gets better because if our income during retirement is from a tax free bucket such as a Roth IRA, that income won’t count as income for tax purposes because it’s tax free. So theoretically, we could have capital gains from buying a stock today such as Apple at $180 and if it grows to $250 over the next 10 years, that $70/share in capital gains could be taxed as low as 0% assuming the tax laws don’t change. The best part is we can selectively choose to sell enough shares to keep us under the $94,050 limit to ensure it’s all tax free. So how would this work in practice? Let’s walk through this example:

In March 2024, I buy 1000 shares of Apple at $180/share = $180,000.

I leave it invested for 10 years and Apple grows to $360/share. So the stock is now worth $360,000. How much capital gains tax do I pay? I’ve made $360,000 – $180,000 = $180,000 in profit.

If I sell ALL the Apple stock and cash out $180,000 in profit I’ll pay 15% capital gains tax of $27,000. But what if I only sell half (500 shares)? $180,000/2 = $90,000. How much tax would I owe on $90,000? According to the table above, the tax would be ZERO! I can then sell the other 500 shares the following year and pay ZERO tax on that too!

This is why Warren Buffet always states that he pays lower taxes than his secretary, it’s these type of tax structures that minimize taxes for those people with large amounts of money. I’m no Warren Buffet but I’m not tax chump either.

Risks

Of course there are risks such as:

- What if Apple stock goes from $180 to $80 or zero? Well I’ll take huge losses and the tax rate becomes irrelevant. There is no free lunch which is why you don’t want to put all your money in one stock or investment class. This is where a “well diversified” portfolio comes into play.

- What if the tax laws change? That’s an almost guaranteed outcome, the tax laws change virtually every year. The current tax brackets are set to expire in 2025 and they will mostly go back up. You can read about it here.

Filling The Bucket

It becomes taxvantageous™ to fill the bucket with investments that can benefit from capital gains and minimizes dividends or interest. In our case, we’re looking to buy some blue chips stocks or the S&P index that have growth potential over the next decade in our taxable account.

Read about my tax deferred bucket or tax free bucket.