I have been doing some spring cleaning and came across an old credit card year end statement from 2001. It was a bit of a ‘blast from the past’ but what really struck me is how much the cost of stuff has gone up. For example, there was a fast food place named ‘Whataburger’ that I visited rather frequently and I always seem to spend $4.58. I assume that was the price of a #1 combo meal so I looked that up and the current cost in 2024 is $9.51. That’s a 107.6 percent change in the price of that meal over 23 years so that’s 4.7 percent per year. Ouch.

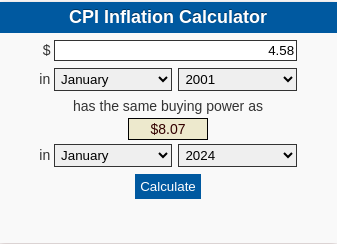

I wanted to double check if this was correct so I went over the the BLS.gov site and used their ‘inflation calculator’ and punched the numbers in to see if they matched.

The calculator was a bit off but then again the BLS calculator is just calculating normal ‘currency’ inflation where as the fast food joint needs to run a business and generate a profit.

Other items like electricity, grocery bills, entertainment were all cheaper back then but that’s standard operating procedure living in a world where governments can print money into existence.

Future Inflation

Assuming that the same inflation pattern holds or gets worse over the next 20 years, we can assume that the cost of almost everything will double by 2044. That fast food combo will likely cost $20 in 2040 or perhaps sooner if inflation ends up being worse. If you have a family of 4 that will be $80 for fast food!

How can inflation be worse than it is now? There are macro events happening all over the world.

- Countries around the world have been de-globalizing after COVID showed critical weak points in the supply chain.

- The global population is aging. China, Europe, the US all have aging populations. In the US alone, there are an estimated 80 million people that will be retired and on social security by 2030. That’s a lot of people to not have working in the country but they will still want to eat and consume stuff.

- Resources get depleted over time, we don’t have an infinite amount oil, gas, food, etc. At some point, things will get tight especially if we have environmental disasters such as droughts for food or fuel disruptions from war.

My Inflation Plan

So what can we do? My plan is simple, I have been creating an investment portfolio that will hopefully get me to the finish line in a comfortable way.

- First, I paid off all my high interest debt. Ironically, if there is an option to take on debt at low interest rates, I will jump on it because high inflation deflates away the debt.

- Second, I invested and will continue to invest in real estate rental properties. If inflation remains high then I will pass along those increases to my renters. Sorry renters, I know this sucks but I have expenses that need to be paid too.

- Third, I have built a bond portfolio. Last week I bought some 30 year TIPS bonds at a great interest rate and locked it in for 30 years.

- Fourth, I am building a dividend stock portfolio with companies that have the ability to pass on price increases and still stay profitable. I will write more on this later.

- Fifth, I will continue to optimize my spend so that I earn rewards for the things that are important to me.

- Sixth, I built a five step retirement plan and am currently tweaking it to understand what I need to do to be ready for retirement and inflation and optimize my taxes.

- Seventh, I am de-cluttering and jettisoning junk I no longer need so that it’s not a burden to store, maintain, or manage.

- Eight, I am exploring possibly retiring overseas in a lower cost country. Why live like an inflation slave in the US when we can live like inflated king in another country.

- Ninth, I continue to explore resources to improve my strategy.

- Tenth, I continue to learn from my personal finance community.