Inflation is like a boa constrictor that slowly squeezes every nickel and dime out of you but lately it feels like a Titanoboa and we must battle it everyday. I got a bit of a shock early this year with the cost of utilities. Both electricity and water went up far beyond what I was expecting but that wasn’t the only thing.

Electricity

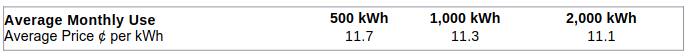

In 2023, I signed up with my electric provide at a rate of 11.1 cents per KW.

It is time to renew so the company sent me this “offer” at renewal time:

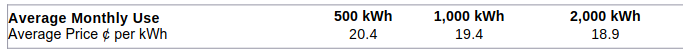

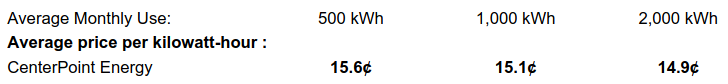

My current electric provider wanted to hike rates a whopping 70% so I said no thanks and shopped around. The rates below were the cheapest I could find.

A change from 11.1 to 14.9 is a whopping 34 percent increase in the cost of electricity.

Water & Sewer

The city sent us a notice that our water and sewer expense would rise 9 percent this year and that’s another whopping increase in expense I wasn’t expecting.

Gas Utility

Natural gas is the only utility that hasn’t skyrocketed this year but we had a huge cost run up a few years ago when all the meters were replaced from the old analog devices to the new digital ones. While natural gas is cheap, the cost to maintain that digital meter seems to keep going up.

Insurance

I wrote about the high cost of insurance here. Our home owners and auto insurance costs have soared the last couple of years. As housing values remain elevated so too will insurance and property taxes remain high and other than shopping around or reducing coverage there is nothing much we can do.

Groceries

Groceries have been wild. Sometimes eggs are really expensive then the price comes down for a while then goes back up. Right now, beef seems to have gone through the roof and veggies vary from high to low but prices generally seem to be higher than normal.

Updating The True Cost of Home Ownership

We may be in a situation where we have high inflation for the next few years so it’s something I am closely tracking and trying to hedge against. I’ll have a future post about some inflation mitigation strategies but for now I will just plan on paying more for less. We will need to re-calibrate our True Cost of Home Ownership model and like that post written just back November of 2023, I am already concerned about inflation again!

What If Inflation Returns from the 70’s?

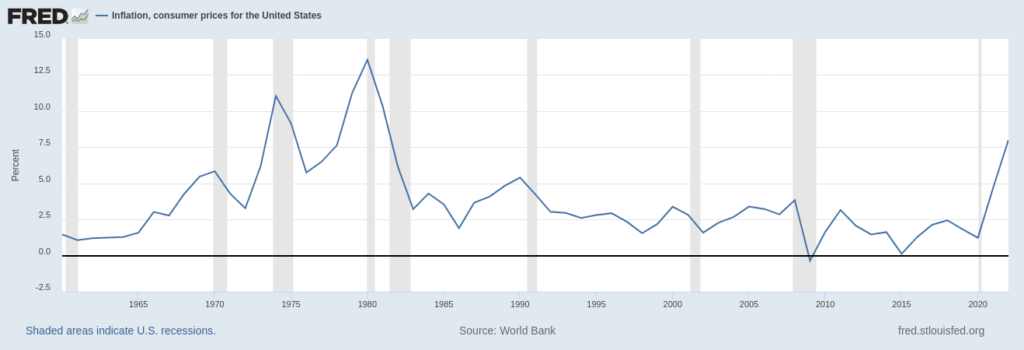

Using my favorite FRED tool, I downloaded the data from the St. Louis Fred to look at the inflation data. The code to use in the Excel FRED plugin if you’re interested in downloading and playing with the data is FPCPITOTLZGUSA or click here. Here are some interesting points:

- From 1968 to 1978, inflation averaged 6.3 percent for this period.

- From 1970 to 1980, inflation averaged 7.7 percent for this period.

- From 1972 to 1982, inflation averaged 8.3 percent for this period.

The chart above is from the St. Louis Fed and it shows how inflation climbed in the early 1970’s and remained high thru the early 1980’s. Will we repeat that scenario again?

We have generations of people that have been born since this period that have no idea how distorted the pricing can become for goods and services. I worry that many will be caught unprepared if we do enter a period like this again. From 2000 thru 2022 inflation averaged 2.5 percent inflation and people have become accustomed to those numbers but will they return for long or will they be way higher?

Financial Modeling

This is why it is vitally important to track your expenses and have forecasting models that will help determine what your future income and expenditures need to be to cope with the changes. Factoring inflation is critical to a safe secure retirement so be sure to add it to your model!

1 thought on “Inflation At Home 2024”

Comments are closed.