The Wall Street Journal has an article (paywalled) out stating that the new number to retire comfortably in the United States is $1.46 million. The article didn’t state if that is per individual or couple but do you think that is correct?

It Depends

Many of these articles are often fairly useless because there are simply too many variables to understand how much money someone will need when they retire. Are they in good health or will illness and medical costs deplete their life savings? Are they in a high cost of living state or a low one? Will they retire in the United States or retire abroad?

I could go on with endless scenarios like size of family, disposition to leave money to family or charity or simple lifestyle choices from extravagant to ultra frugal.

My Retirement Plan

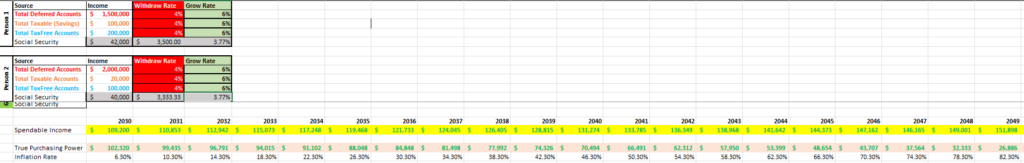

Ironically, the WSJ article came out at a time that I finished my first draft of my retirement planning spreadsheet. In the spreadsheet, my primary concerns were tax rates, tax brackets, portfolio draw down, portfolio growth rate and inflation. Of all of those things, inflation is the biggest concern because once I retire it will be hard to go back to working a full time job, particularly if I am elderly or disabled in some way.

Inflation! Inflation! Inflation!

In a recent post, Inflation At Home 2024, I wrote about the historical decade period in the 70’s where inflation averaged between 6.3 percent and 8.3 percent so I went back and put those variables in my retirement spreadsheet.

6.3 Percent Inflation, 6 Percent Growth

At 6.3 percent inflation and 6 percent portfolio growth, by the year 2045, the purchasing power of my portfolio will be $48,654 per year. It’s hard to live on $50k/year now so imagine what that may be like in 2045!

8.3 Percent Inflation, 6 Percent Growth

At 8.3 percent inflation and 6 percent portfolio growth, by the year 2041, the purchasing power of my portfolio will be $535 per year. That’s not a typo, it is literally five hundred thirty five dollars per year. After that, the portfolio purchasing power goes negative.

Keep in mind that the portfolio is still generating income, the problem is with inflation eating up the value of those dollars leaving me with the equivalent of thinking it’s 1955 when burgers cost $0.15 but living in 2024 where burgers cost $15. In 2045, a burger may very well cost $125.

Conclusion

All we can do is try to hope for the best but plan for the worst, maximize our portfolios, spend down debt, and earn more than we spend to live a long comfortable retirement.