Over the course of my career, I’ve collected a cornucopia of brokerage accounts. During that time frame, many of these brokers began buying each other out. For example E-Trade got swallowed up by Morgan Stanley, TD Ameritrade is now Charles Schwab. Fidelity is probably one broker that hasn’t been swallowed up or changed names over the years as far as I know. So which one is the best one to use?

It Depends

Which broker is best to use is entirely dependent on the person and their needs so I decided to write a pro and con of the three major brokerages that I use and a new comer to the scene with some promising advances in finance tooling.

Fidelity

Many people will end up with a Fidelity account because they are one of the the largest providers of 401k accounts so over the course of a very long career you are bound to end up with a Fidelity account.

Pros

The main thing I like about Fidelity is the cash management which pays a fairly high interest rate when compared to other brokers. If you have short to mid term periods of time when you hold cash then Fidelity is the best place to stash cash.

Cons

My biggest complaint about Fidelity is the clunky Frankenstein web interface. The web portal isn’t a seamless experience but an amalgamation of different sites patched together. For example, let’s say you buy a dividend stock like XOM, if you want to DRIP the dividend, you have to navigate through several awkward screens just to find and turn on the feature (Accounts & Trade -> Account Features -> Dividends & Capital Gains -> Manage, then manually change each one or ALL of them). Why isn’t there a simple DRIP button next to the shares you hold?

Buying Bonds is another multiple click screen journey that is too time consuming, why isn’t there a BUY BONDS button? The stock screener feels a bit clunky too. I honestly don’t know why these brokers don’t partner with third parties like SeekingAlpha who already have a really good stock research tool.

Charles Schwab

I ended up with a Schwab account when they bought TD Ameritrade. I really liked TD Ameritrade’s ThinkorSwim platform but lately, under Schwab, it’s been crashing a whole lot. I called to complain and they suggested I use the web version which is vastly inferior than the PC version of the software. I could write week long posts on the capabilities of ThinkorSwim but I really don’t know it’s future under Schwab.

Pros

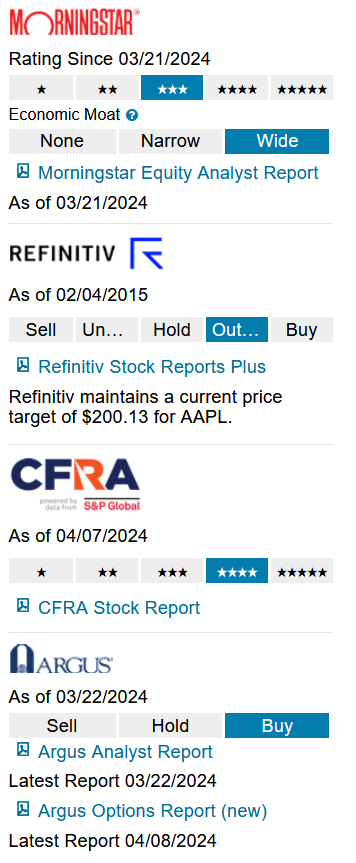

I recently discovered that Schwab has some amazing tools and access to third party analyst reports such as MorningStar, Refinitiv, CFRA, Argus. I also really like the layout of Schwab and the detailed data available on the platform. The stock screener rivals SeekingAlpha and once I master it, I may cancel my Seeking Alpha subscription.

Cons

Cash management as Schwab is lackluster and they pay very low interest rates on my cash. By my calculation the interest rate is 0.004 based on the income projections listed in Schwab. Of course, I keep my cash in T-Bills but still, if you keep large sums of cash, Schwab isn’t the best place to do it to earn hassle free money like Fidelity.

Morgan Stanley

I have the least amount of money at Morgan Stanley and it’s with good reason, it’s the least favorite brokerage but it has some really good positives too.

Pros

E-trade has many live webinars and other training tutorials to fully walk you through the E-trade trading platform. The platform itself has neat things such as Strategy Builder and TradeLab but I honestly don’t have the time to sit there an learn another platform.

Cons

Brokerage firms that cheat their customers out of the current high yield interest paradigm are an automatic turn off for me. E-trade regularly insults me by sending me app notifications that state they’ve credited $0.01 in interest to my account. I suspect it costs E-trade more money to send that notification in electricity and other costs but as long as the customer is unhappy it’s mission accomplished for Morgan Stanley.

Empower

I recently added an Empower account and I’ve been playing around with the capabilities. Right now, Empower has an interest rate of 4.7% on cash sitting in your account but it seems to be a very primitive account with no debit card access to your money.

Empower promises to have some really nifty finance tools but I haven’t tried them and I’m reluctant to add all of my accounts so a firm can snoop through all my bank , retirement, and credit card accounts.

Conclusion

As of April 2024, I have four brokerage accounts (ordered in priority) and they all have some pros and cons but the main reason why I don’t consolidate, and probably never will, is because of what happened in 2008 and through other periods where many of the brokerage firms go bankrupt. SIPC only insures $500,000 at a brokerage account so the best thing for me to do is simply spread my wealth across multiple accounts.

In addition to the added security of ‘diversification’ of brokerage accounts I also get access to each firms unique tools and offerings. Competition is good and I’m still waiting for one of these brokers to add AI to help with my investing. I suspect the first one to do so will cause money to flow into new directions.

If you have a really cool broker, let me know about it in the comments.

Good article! Two additional things I like about Schwab are the ATM card, which reimburses for any transaction fees, and the PAL asset based credit line, which is super useful. But like you, I hate the low interest rate on cash, so I use the WealthFront checking account to pay all by bills (currently five percent).

Thanks. I will check out WealthFront.