In my post, What They Don’t Tell You About About Retiring Overseas, I wrote about how my wife and I are avid travelers. With one of our kids now seemingly living in Europe on a semi-permanent basis it makes a great deal of sense for us to consider buying a home somewhere in Europe to be closer to our son.

To that end, I continue to watch YouTube videos of people that have moved or are planning on moving overseas so we came across this video from Seeking Paradise Bugs that talks about the three Spanish taxes to look out for when moving to Spain.

The three taxes to consider: Income Tax, Wealth Tax, Inheritance Tax

Income Tax

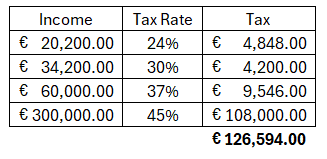

The couple in the video confirms my suspicions on the ultra high tax rates of 47 percent for income over 60k euros. Based on my retirement calculator, we would generate around $250k in retirement income and additional $60k putting us into the $300k/year income range. I did a quick back of the spreadsheet calculation and determined we would owe 127k euros in taxes each year or 10,584 euros/month just for taxes!

Wealth Tax

The pain doesn’t stop at income taxes, there is a wealth tax to consider too if your total net worth is over $3 million, you have to pay additional tax to Spain too to “help the little guy” and make their lives better.

Inheritance Tax

Afterwards, if you somehow manage to overcome the income and wealth tax and you or your spouse dies, Spain will slap on an inheritance tax on all those assets bequeathed to you at a very steep rate.

Spain Is Out

After watching this video, Spain is officially out of our selection process. It’s unfortunate too, we love Spain and it’s a country with a great deal to offer but we would be fools to pay that kind of money to live there. Given the volatility of tax laws shown in the video, sometimes getting better then having a regime change and altering tax laws for the worse, it’s not worth the risk. It’s not worth the risk to build a life there only to have the rug pulled from under you because some tax hungry politician wants to extract money from unsuspecting and vulnerable people.

Ironically, by punishing high income earners with insane taxes, Spain virtually guarantees that the only people that will move there are those that won’t pay enough in taxes to cover their long term social costs, those people making less than 60k per year.

We will simply visit Spain but plan on never ever staying more than 183 days in any given calendar year. It would literally be cheaper to pay $5000/month for an overpriced AirBnb for 5 months than pay $10k in taxes every month for a year.

Onto the next country….

I think that there’s something wrong in this post, you are comparing it to the American tax system and thinking that it works the same way. If you’re living from your portfolio, in Spain you don’t pay income tax but capital gains tax. Even though that this tax is quite high as well, it’s way lower than income tax (it goes from a 19% to a 23% for gains over 50k€). In the wealth tax, your primary residence is also not included (up to 300k€)

I don’t think there is anything wrong with the post. We expect to have income from the following:

1. Social security – $7000/month or more. This is taxable, we are not civil/public employees.

2. Rental property income – $5000/month or more. This is taxable income in Spain.

3. Interest Income (from bank) – $2000/month or more. This is taxable income, I don’t think this is capital gains but correct me if I’m wrong.

4. Dividend Income (from stocks) – $15000/month. If this is capital gains then it helps but add it all up and we are approaching 300k. If not then we’re really screwed.

5. Capital gains (from stock sales) – I don’t know what these amounts will be but we’re already at $300k+ and I’m using conservative estimates.

6. Other income – I have other income that I won’t go into detail here from other side businesses that will get taxed too.

I’m not sure how the wealth tax works and I don’t care because I’m not going to risk it. The fact Spain changes tax laws so frequently (according to the video) makes it unstable enough that it causes risk. For example, let’s say they repeal the wealth tax and lower other taxes next year, we move there then they change their minds and bring the wealth tax back and raise income taxes, we would have to move all over again. The best thing to do is find a more tax stable and friendly country or have a 10 year guarantee tax rate.

Italy has special zones that have 7% tax rate, we are looking into those now.

Don’t worry, we will visit Spain many times just not invest our lives there.