The Bureau of Labor Statistics releases their Consumer Price Index report monthly and the one for May came out this week. It’s one of the few government statistics report that I actually look at to see trends and do personal finance forecasting. So what’s happening with inflation?

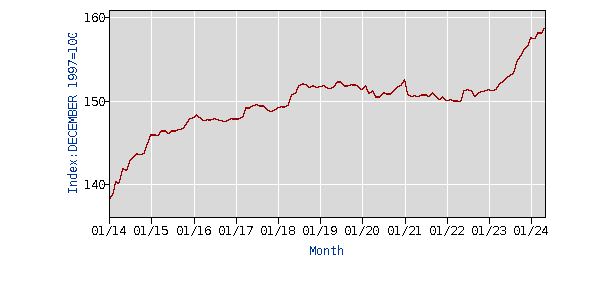

Household Insurance

Home owners (and renters) insurance continues to climb. I’m feeling the pain and recently wrote about our Flood Insurance doubling in cost.

The high cost of insurance also impacts my rental portfolio because I will need to pass on those costs to my tenants.

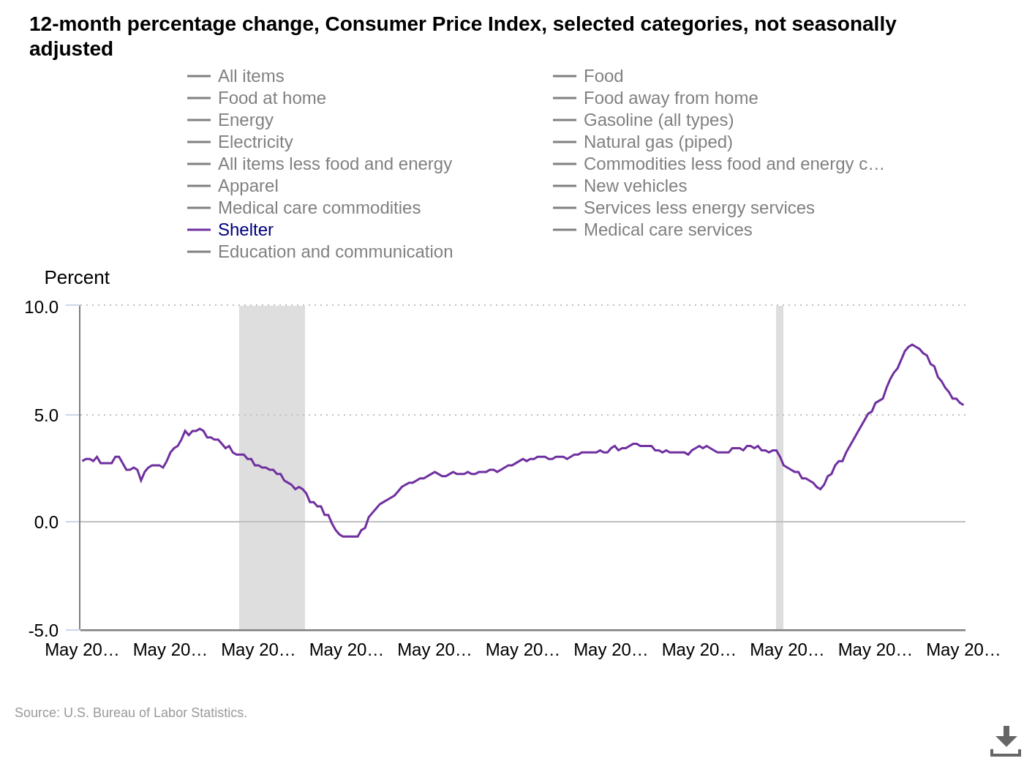

Shelter

The inflation rate for shelter for May is 5.4 percent which is extremely high and as long as insurance rates continue to climb along with other expenses, the Shelter CPI won’t be coming down anytime soon.

From a forecasting perspective, I need to be sure to monitor this as it impacts competitive rates for my property rentals.

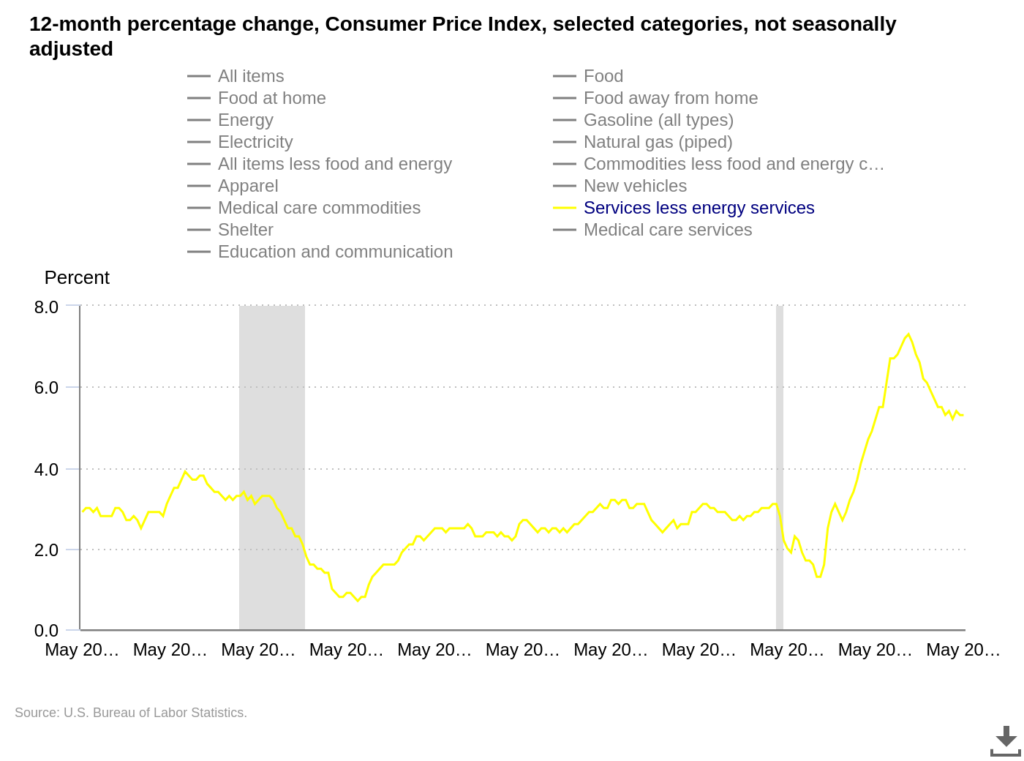

Services

The ‘Services less energy services’ remains elevated at 5.3% and this means that we are all paying higher rates for services. Whether it’s a hair cut or fixing HVAC units, the costs of all of this continues to climb. As a rental property owner, I need to pass these costs onto renters which explains why the SHELTER category continues to climb.

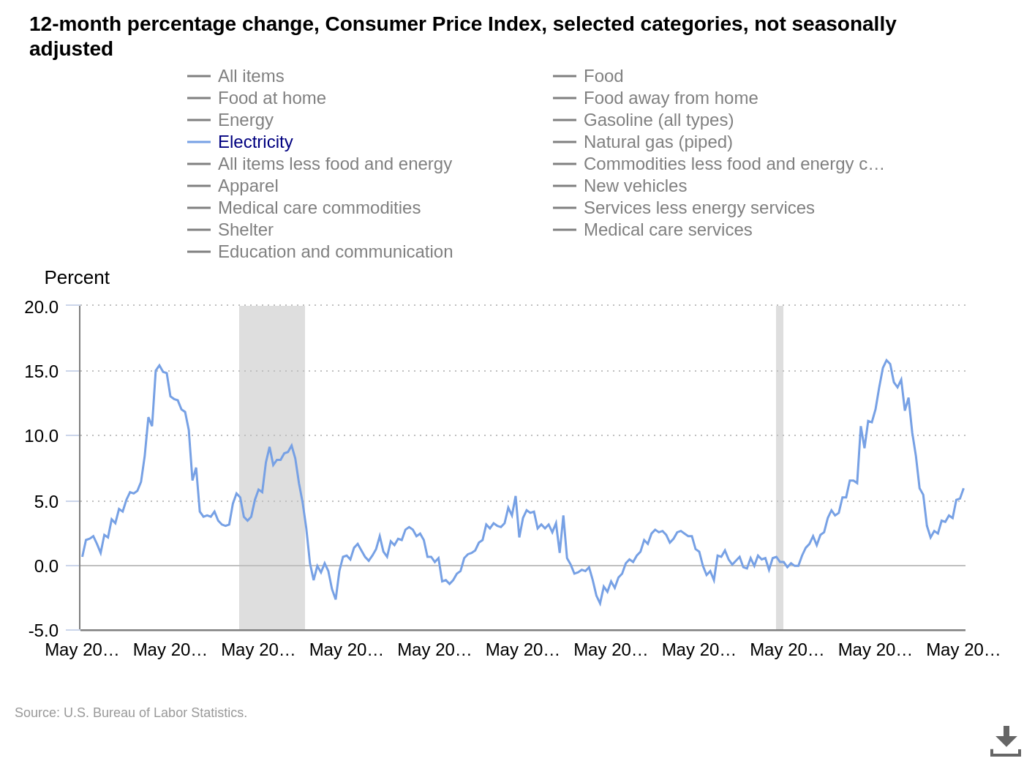

Electricity

The cost of electricity is up 5.1 percent in May. I don’t offer “free” utilities with my property rentals however an increase in electric rates means my tenants will be strapped for cash so it’s important to monitor possible changes to their cash flow.

Forecasting

As you can see from the latest inflation report and the charts above, things aren’t getting much better all the while many people are hoping for the Federal Reserve to cut interest rates. If the Fed cuts rates, it will make borrowing money cheaper and encourage spending which will lead to inflation spiking again.

If the Fed cuts rates it will create an inflationary cycle that will be hard to break.

Share The Wealth

What’s your plan for inflation? Are you going to let your lifestyle deteriorate (spend less than you earn) or will you find new income sources (earn more than you spend)?