Follow up on my earlier post to buy $30,000 in municipal bonds, I continue to load up on these bonds with ~6% tax free equivalent yield to lock in higher rates for tax free income in case the Fed decides to cut rates.

I want to share some thoughts on my strategy with picking these bonds and some of the tools I use to discover them.

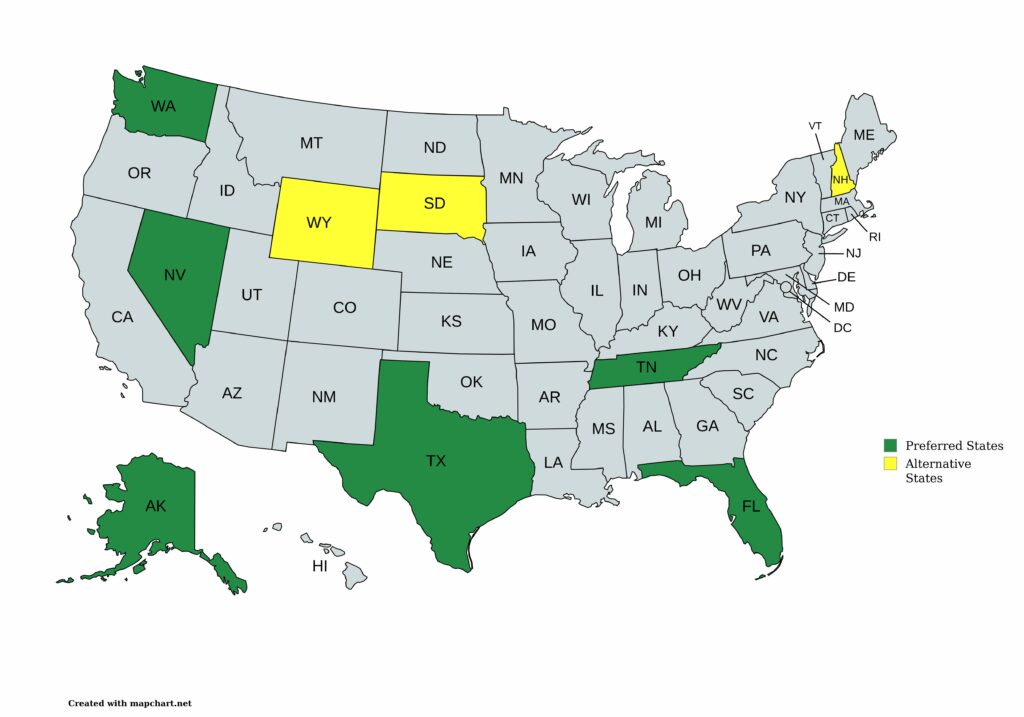

Step 1: State Income Tax Free States

The map above shows the 9 states in the U.S. that don’t have a state income tax. I have color coded them green and yellow to illustrate the ones I prefer first (green) and the ones I would consider if I can’t find anything in the green section.

Why not prioritize Wyoming, South Dakota & New Hampshire? These states have slow or no population growth and that could possibly lead to higher rates of defaults over time. WY, SD, and NH also are top heavy older people that will be constrained on fixed income and generally pay lower taxes through property tax exemptions and other social programs.

Texas, Florida, Tennessee and Nevada have had significant population growth over the past decade and while Alaska isn’t growing, it is mineral and resource rich.

Step 2: Tools (Websites)

There are two main ways I get lists of municipal bonds. The first is simply through enabling alerts through Fidelity.com. To setup alerts on Fidelity you click News & Research –> Alerts –> Fixed Income & New Issues –> Alert Setup and follow the prompts.

Depending on how you setup, you will receive alerts on the Fidelity app on your phone or email messages. If you don’t like to get spammed like this on your email or device there is an alternative manual way under News & Research –> Fixed Income will have a list of bonds available.

EMMA – Electronic Municipal Market Access

There is a website emma.msrb.org that also provides lists of municipal bonds for every state and has customize-able search options by State, City, County, or other Issuers.

Step 3: What To Avoid

I wrote a blog post awhile ago indicating bonds that I prefer not to buy and stated the reasons there and I have stuck to my rules. Note: Municipal bonds are only state income tax free if you live in a state with no state income tax or the municipal bonds you buy are from the state you live in. For example, if you live in California (a state with an income tax) then only California municipal bonds are state income tax free. Buying a Texas municipal bond while living in California will incur a California income tax on interest earned from Texas. If you live in a state with no state income tax then all other municipal bonds from other no state income tax states will be tax free.

Here are my rules:

- Buy municipal bonds only in state income tax free states

- Buy municipal bonds only in growing population regions

- Buy municipal bonds whose primary proceeds are for schools, transit/roads, or infrastructure and avoid all others, especially housing bonds.

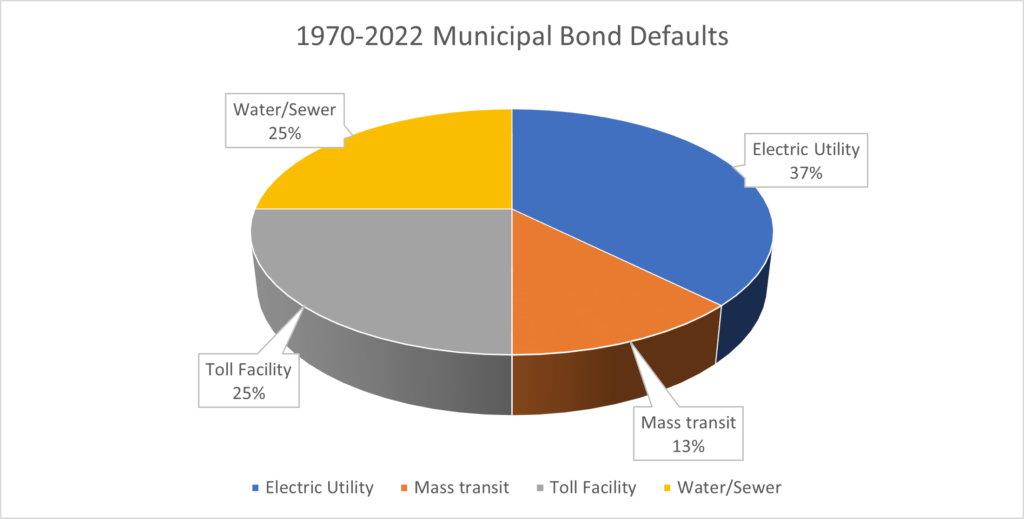

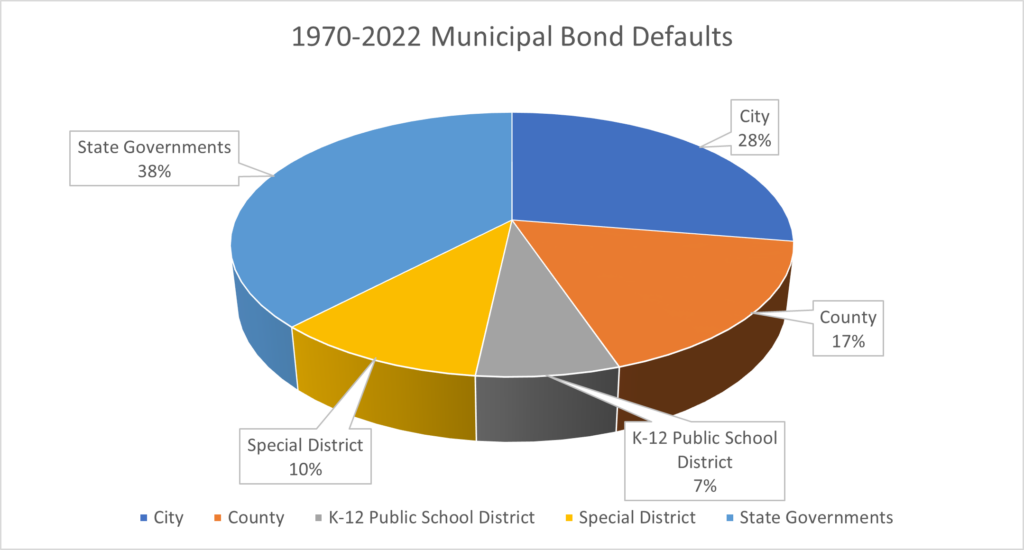

- Avoid munis with high defaults as listed in the charts below.

2024 Purchases

So far I’ve purchased $20,000 of municipal bonds and another $10k of municipal bond ETFs (NEA) and I will likely continue adding to NEA and any new municipal bonds that look interesting. All of these bonds are callable in 2030 so if interest rates have dropped significantly, they may be called back but I’ll earn the tax equivalent yield of ~6% until then.

Alternatively, if interest rates dropped precipitously over the next year or two the value of these bonds may increase accordingly so I hope this turns into a win-win either way.

Share The Wealth

Are you loading up on tax free municipal bonds during these “high” interest rate time frames? Let me know in the comments below.