“The stock market is overvalued”

“The stock market is going to crash”

“The stock market is a scam”

“The stock market is a casino”

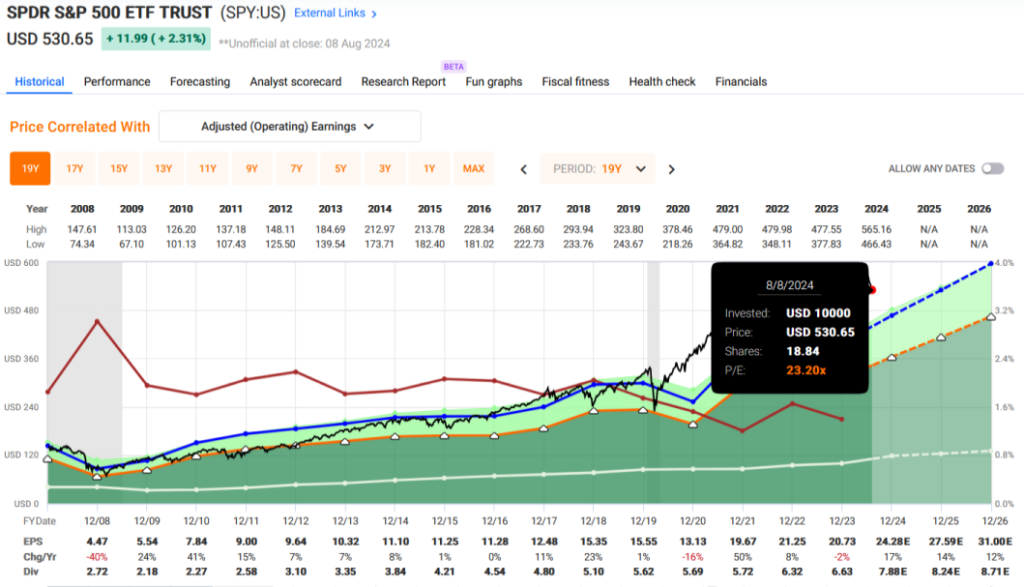

These are some of the quotes I’ve heard from people over the past few months, years, decades….heck, I might have said some of these quotes myself at one point or another. To be fair the chart below of SPY (S&P 500 ETF) looks a bit scary so what is a skeptical investor or person to do?

Long Term Historical Trends

On average the historical long term returns of the S&P 500 has been 10% and there have been various “crashes” since 1926 but even including those crashes, the market still returned 10% annually over the long term average.

The obvious question to ask now however is if the market is over valued and can we expect a correction or crash sometime over the next few months or years.

For the first part of the question, we can look at the current S&P 500 multiple using one of my favorite tools, Fast Graphs.

SPY was trading at 23.20x earnings with a value of $530.65 as of August 8, 2024 where a traditional/normal P/E is 15x which would infer that SPY should be trading at $343 suggesting the S&P 500 is over valued by ~43% as of August 8 2024.

How To Invest In Overvalued Market?

There are several ways to invest in an over valued S&P 500 index. First, not all the stocks in the S&P 500 are over valued. It’s possible to find some stocks that are at fair or below fair value at the moment using a tool like Fast Graphs or Seeking Alpha.

But if you’re the type of person that only likes to invest in S&P 500 index, buying the index now doesn’t make a great deal of sense if it is indeed over valued by 42% so what to do?

Selling Puts On SPY

I like SPY and I’d love to buy some but not at these prices so what I am doing is selling cash secured puts into the future to get a chance to buy SPY at what I consider fair value and get paid for waiting.

The image above shows the sale of an SPY PUT for December 20, 2024 at $340 strike price. It shows that I sold the contract for $148.32. On December 20, 2024 there are three possible outcomes.

- If SPY is trading ABOVE $340, the contract will expire worthless and I will keep $148.32.

- If SPY is trading at or BELOW $340, the contract will be assigned I will need to pay $34,000 to buy 100 shares of SPY.

- if SPY trades BELOW $340 at any point between now and Dec 20, 2024, I *may* be assigned the contract and have to cough up $34,000 at that point in time.

A simpler way to look at this is to imagine you are in the market for a vehicle (like a truck) and the current price of the truck is $53,065 (SPY @ $530.65) but it’s possible the truck will be on sale in December for $34,000 (SPY @ $340). What if you got paid $148.32 to wait till December to see if the truck goes on sale at a 42% discount?

I’ve actually entered this transaction and it doesn’t stop with SPY. I have similar positions on other stocks that I’d like to own that I’ve sold naked (cash secured) puts.

Selling Covered Calls On Stocks

Another trick to use if you think stocks will drop in value is to go short on those stocks by selling calls at a certain strike price.

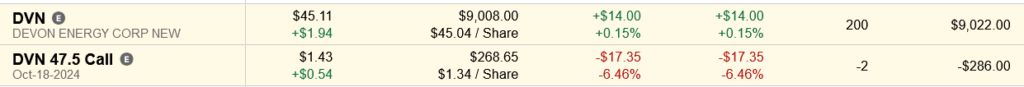

In the example above, I bought 200 shares of DVN at $45.04 and sold October 18, 2024 $47.50 calls. I was paid $1.35 x 2 x 100 = $270 in premiums for those 2 contracts. Like SPY, there will be three possible outcomes here.

- On Oct 18, 2024, if DVN is ABOVE $47.50, I will be forced to sell it at $47.50 earning an additional [200 x ($47.50-$45.04)] = $492 and I keep the premium of $270 for a total of $762 in profits.

- On Oct 18, 2024, if DVN is BELOW $47.50, the contracts will expire worthless and I keep the $270 premium.

- If DVN rises ABOVE $47.50 anytime before Oct 18, I may be forced to sell it at $47.50.

The last point #3 is important because DVN has a dividend of $0.22/share payable for those who own the shares on the record date of 9/13/2024. If I am able to hold on to the shares, I will score an additional $44 in dividends.

For the month of July, I’ve scored about $8000 in profits from selling cash secured puts and covered calls but you should note that this strategy requires large capital reserves to protect against margin calls. In the SPY example above, I have to keep $34,000 in cash on standby for a margin call. Fortunately, that cash earns 5% interest at Fidelity.

The Clincher

But to answer the question, how to deal with stock market skeptics, the answer that has worked well for me is to ask them to do one thing: Split your portfolio and test the theory.

Here is what I tell skeptics specifically and I’ll use the example of “Fred” who is a big gold bug and hates the stock market. I told Fred to take $10,000 and buy gold and take $10,000 and use the naked puts strategy on SPY. He needs to keep both for 5 years and at the end of five years we’ll check back to see which fared better.

Gold in November of 2019 was $1450, this week is $2500, a 72.4% return.

SPY in November of 2019 was $319, this week it’s $549, a 72% return however SPY pays dividends and if you are collecting premiums from the naked puts, the returns are higher.

And yes, it’s possible for the price of gold or SPY to correct or even crash, that happens in any normal functioning market so it’s best to be diversified.

Diversification

Lastly, the most important thing to remember is to diversify and never put all your eggs in one basket.

Share The Wealth

How do you deal with stock market and financial skeptics? Let me know in the comments below.