I strongly believe that parts of the U.S. stock market are over valued but that doesn’t mean I stopped investing. I decided to write this post because I’ve been spending time on Reddit investing communities and almost all of the advice is the same when someone asks for investing help: “Just buy VOO!”

I think that approach isn’t generally wrong but that’s not the only answer especially when there are many different factors as play such as age, retirement goals, amount of money accumulated and more. To that end I decided to share my current portfolio. Please don’t take my portfolio and think this is the right thing for you. I can change positions at any given point, especially if the market corrects significantly and I want to optimize my portfolio but at least it offers an alternative view to “just by VOO!”

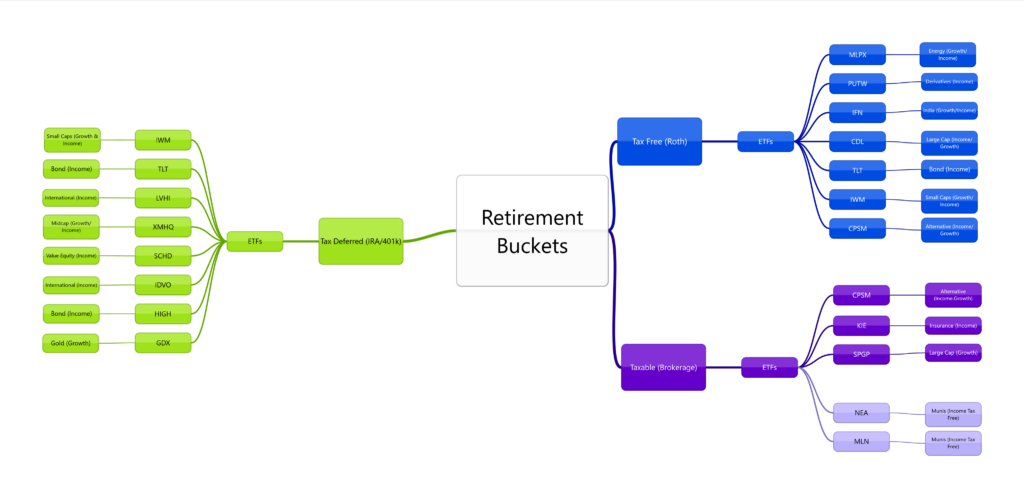

I have three retirement buckets: Taxable; Tax Deferred; Tax Free.

Tax Deferred Bucket

The tax deferred bucket includes ETFs I carry in my IRAs and 401k. I try to create diversified portfolio and ensure there is minimal overlap using the ETFRC overlap tool. I have written some notes in the image regarding the purpose of each ETF such as growth or income or both. In this bucket I have GDX, HIGH, IDVO, SCHD, XMHQ, LVHI, TLT, IWM. These funds won’t be touched for a very long time.

Here’s some of the overlap test

- XMHQ vs LVHI = 0%

- IDVO vs LVHI = 0%

- SCHD vs XMHQ = 1%

Taxable Bucket

The taxable bucket is my regular brokerage accounts. Because these are not tax advantaged in any way, I try to minimize taxable income and focus on growth (capital gains) and tax free investments. The ETFs in this bucket are: MLN, NEA, SPGP, KIE, CPSM. These funds will be used immediately after I retire.

The overlap between SPGP vs KIE = 6%.

Tax Free Bucket

The most important bucket, in my opinion, is the one that will growth tax free. I want both income and growth here as it will all be tax free so this bucket contains: MLPX, PUTW, IFN, CDL, TLT, IWM, CPSM. These funds will be used at the most tax advantageous time.

No overlap in any of these funds.

What’s Next?

There are plenty of ETFs I would like to add to my portfolio but because they are way over valued I will wait; some of those are VUG, XLG, SPY, QQQ, JEPI, and others. I am contemplating adding a small leveraged ETF position to my account to juice returns but that’s a post for another day.

It’s also important to re-balance your portfolio if it becomes too top heavy any particular investment. I spent a great deal of time researching ETFs that offered a fair balance of value, income and diversification. It’s important to note that I often sell calls on these ETFs to juice extra returns too.

Share The Wealth

What’s in your ETF wallet? Let me know in the comments below.

1 thought on “The ETFs In My Retirement Buckets”

Comments are closed.