I got a notice that one of my 20 year bonds earning a nice 6.8% interest rate got called. I expected this to happen so it’s not a huge issue but it does suck to lose a bond paying 6.8% interest rate. I am writing this post to make people aware that these things happen and as long as you know what you’re getting into it perfectly fine.

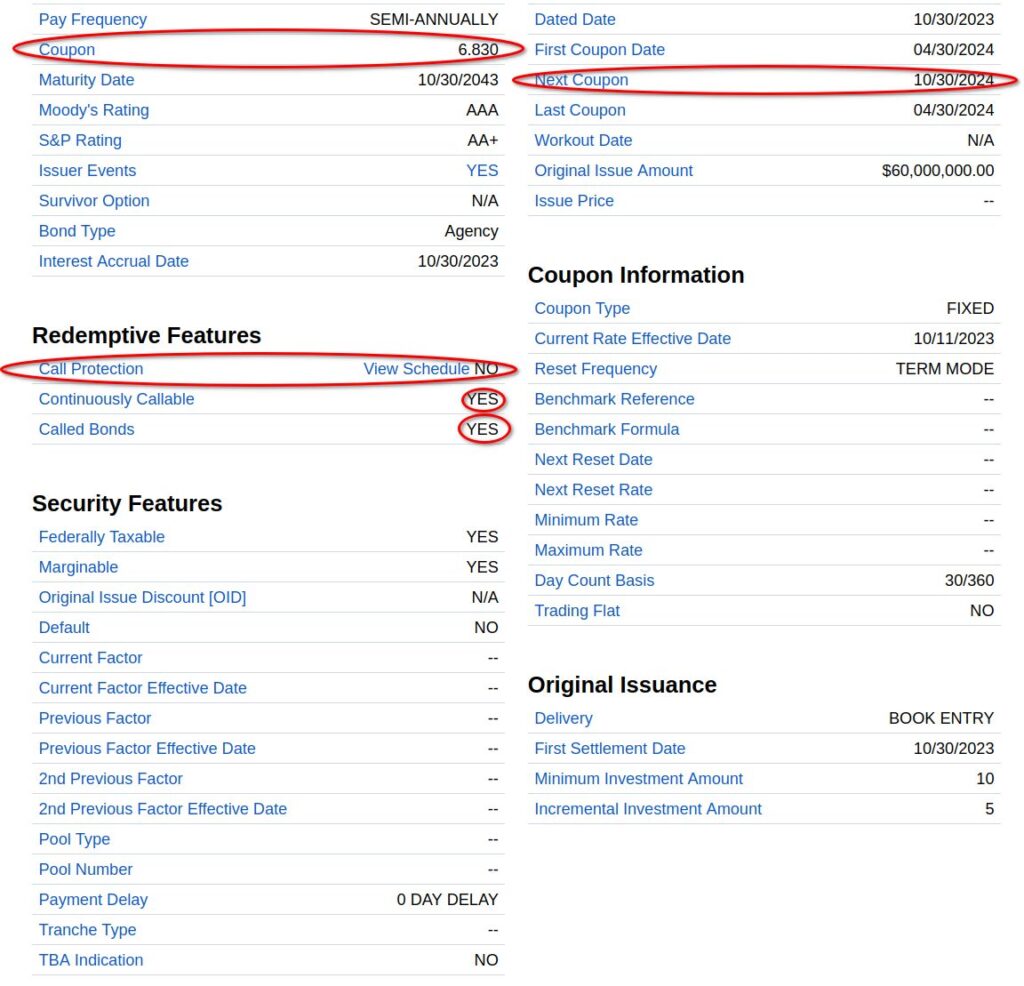

Here is the info of the bond I had.

The bond will be called at the end of October so I am anticipating one more interest payment then full redemption.

I also have another two year bond that matures at the end of October so I’ll need to find new bonds or investments for all that cash.

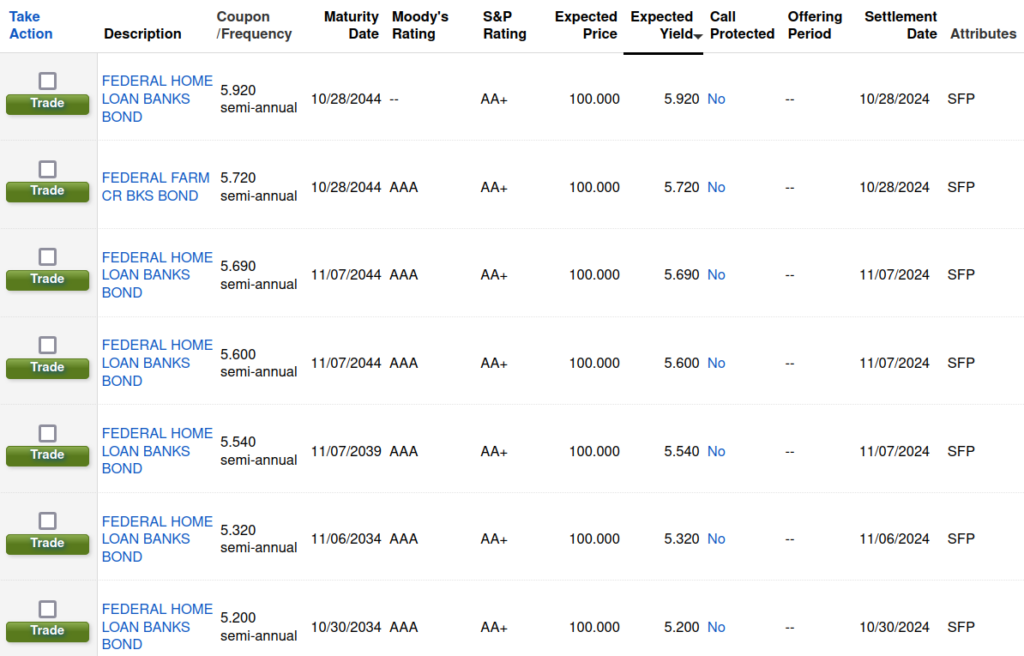

I checked Fidelity’s Agency/GSE list and the bond yields are far lower than they were last year by about 1 percent.

It’s possible if I buy a 20 year bond today it may get called again next year so I need to decide if 5.9% is good enough for 20 years.

Share The Wealth

What’s in your bond portfolio? Let me know in the comments below.