It’s the dot com bubble all over again! I’ve spent a few days researching topics and opinions on Reddit and other social media and there is quite a bit of stock market exuberance. The S&P seems to be breaking all new highs on a daily basis, bitcoin broke $80000 this week and keeps climbing and everyone online is bragging about how much money they’re making in the stock market.

I saw and heard most of this (except bitcoin) back during the dot com bubble and then it all came crashing down. They say that the stock market can remain irrational a lot longer than most people can remain solvent so there is no way to know when all of this will normalize.

Cashing Out

Every time the markets hit new highs, I’ve been strategically selling off small portions of my portfolio. While I truly believe that a correction is coming and that a recovery will happen soon after, I have no interest in losing 20% or 40% or more of my portfolio and wait 10 years for it to recover so I need to do the prudent thing and move to cash until the correction and then decide if I want to get back in.

Of course, I am still earning money, T-bills are paying 4.5% and money market funds are paying similar but I’ve been through this rodeo before and gotten thrown off the bull so I’m taking a break and just going to sit and watch.

Back in July, I wrote this post asking Are You Prepared For A Lost Decade? thinking the market couldn’t sky rocket any higher and I had been moving to cash then and doing more now.

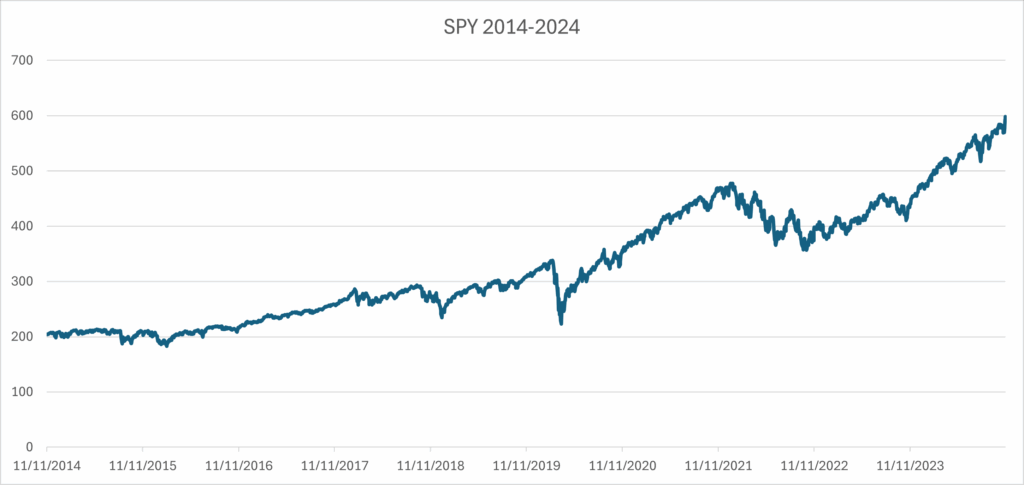

SPY 2014-2024

It’s entirely possible that the market simply keeps going up forever from here but history shows that doesn’t happen, valuations eventually come back to normal and all they need is a trigger.

Triggers

I’ve been thinking about what could trigger a market crash and been researching the topic and here are my top worries.

- New Administration – Trump has promised tariffs and mass deportations. If he follows through on both of these fronts, we will end up with massive inflation and that won’t be good for markets.

- Insurance – I came across a great article about a “Lehman” lurking somewhere in the insurance industry and this article is worth a review if you care about your portfolio.

- CMBS Defaults – #2 and #3 are linked. If you understood what happened during the 2008 GFC, there are scenarios where that will repeat again but with commercial real estate instead of residential and loan defaults for commercial real estate are reaching 2007 levels now.

- War – Whether it’s the middle east, Russia/Ukraine or China/Taiwan any one of these escalations could lead to massive supply chain disruptions for microchips, oil, food or all three.

- Black Swan – There are growing concerns over bird flu, weather events, and ability of consumers to just keep spending but there is no way to know what may come next.

Share The Wealth

Are you prepared for a lost decade? Let me know in the comments below.