I was reading various discussions around investments portfolios and the big missing piece in all of those discussion was a complete understanding of financial instruments available to help diversify and risk mitigate an investment portfolio.

I decided to use AI to test my knowledge and I did pretty well but it gave me the idea to write this post and share the information with others in case some of all of these financial instruments may be able to help manage your portfolio and portfolio risk.

These financial instruments are assets that can be traded or used as a means to transfer risk or provide financing. They come in many forms, each with unique characteristics, purposes, and risk levels. Here’s an overview of the main types of financial instruments:

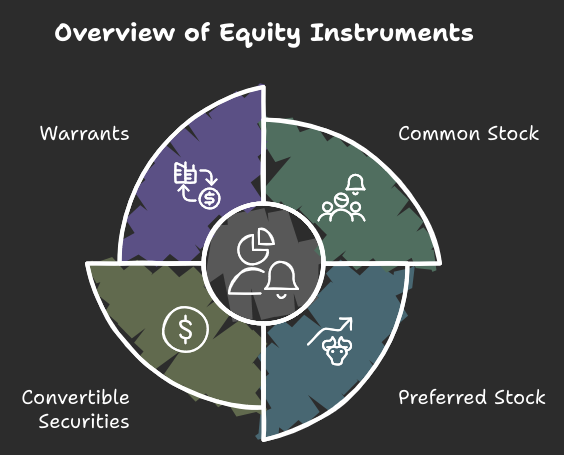

1. Equity Instruments

- Common Stock: Represents ownership in a company and entitles the holder to voting rights and dividends (if declared).

- Preferred Stock: Also represents ownership but typically without voting rights. Holders receive dividends before common stockholders.

- Convertible Securities: Preferred shares or bonds that can be converted into a specified number of common shares.

- Warrants: Grants the holder the right to purchase the company’s stock at a specific price before expiration.

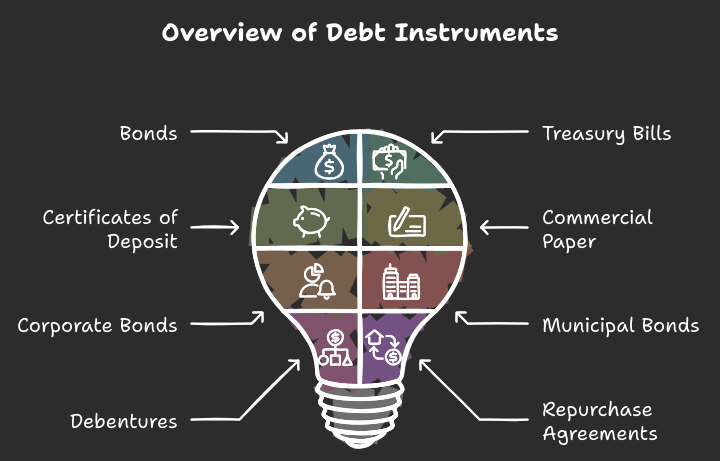

2. Debt Instruments

- Bonds: Long-term debt securities issued by governments, corporations, or municipalities to raise funds, with interest payments (coupons) and repayment of principal at maturity.

- Treasury Bills (T-Bills): Short-term government securities with maturities of one year or less, sold at a discount and paid at face value at maturity.

- Certificates of Deposit (CDs): Savings products offered by banks that pay fixed interest and have specified terms.

- Commercial Paper: Unsecured, short-term debt issued by corporations to meet short-term liabilities.

- Corporate Bonds: Bonds issued by companies to raise capital, which typically offer higher yields due to increased risk compared to government bonds.

- Municipal Bonds: Bonds issued by local governments, often tax-exempt, to fund public projects.

- Debentures: Unsecured bonds backed only by the creditworthiness of the issuer.

- Repurchase Agreements (Repos): Short-term loans where securities are sold with an agreement to repurchase them at a higher price.

- Mortgages and Mortgage-Backed Securities (MBS): Loans secured by real estate property, often pooled and sold as securities to investors.

- Asset-Backed Securities (ABS): Bonds backed by assets such as loans, leases, credit card debt, or receivables.

3. Derivatives

- Options: Contracts that give the holder the right, but not the obligation, to buy or sell an underlying asset at a specified price by a certain date.

- Futures Contracts: Agreements to buy or sell an asset at a specified price on a future date, typically used to hedge against price changes.

- Forward Contracts: Similar to futures but are private agreements between two parties and not traded on an exchange.

- Swaps: Contracts in which two parties agree to exchange cash flows or other financial instruments, commonly used to manage interest rate or currency risk.

- Interest Rate Swaps: Exchanges of interest rate payments, often fixed for floating.

- Currency Swaps: Exchange of principal and interest payments in different currencies.

- Commodity Swaps: Exchange of cash flows based on commodity prices.

- Credit Default Swaps (CDS): Insurance-like contracts that protect against the default of a borrower or bond issuer.

- Options on Futures: Gives the holder the right to enter into a futures contract at a specified price before a certain date.

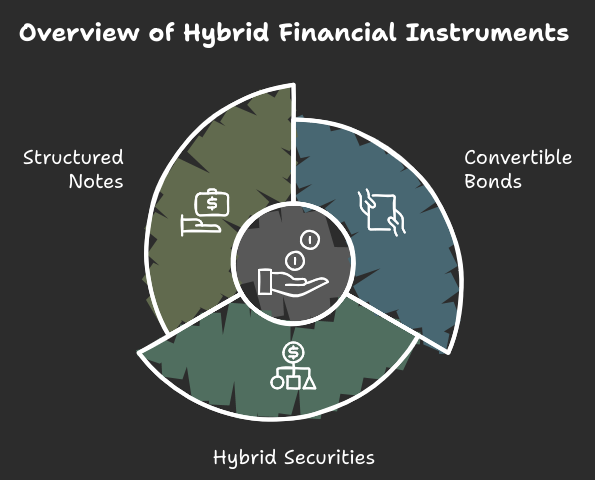

4. Hybrid Instruments

- Convertible Bonds: Debt securities that can be converted into a company’s equity at a predetermined rate.

- Hybrid Securities (e.g., preferred stock with embedded options): Instruments that have features of both debt and equity, like perpetual bonds or redeemable preference shares.

- Structured Notes: Customized debt instruments with additional features, such as equity participation or commodity exposure.

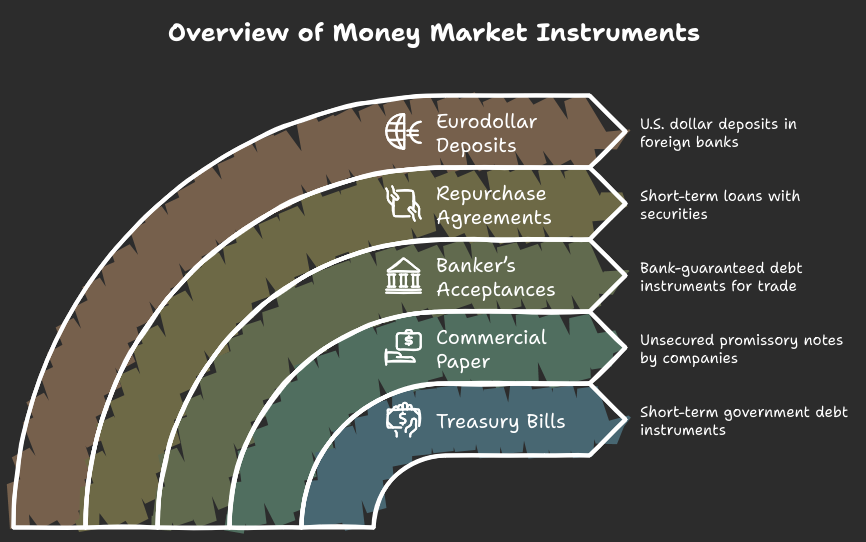

5. Money Market Instruments

- Treasury Bills (T-Bills): Short-term government debt instruments with maturities of one year or less.

- Commercial Paper: Short-term, unsecured promissory notes issued by companies for quick capital.

- Banker’s Acceptances: Short-term debt instruments guaranteed by a bank, used mainly in international trade.

- Repurchase Agreements (Repos): Short-term loans where securities are sold and repurchased on an agreed date.

- Eurodollar Deposits: U.S. dollar-denominated deposits in foreign banks, generally with short maturities.

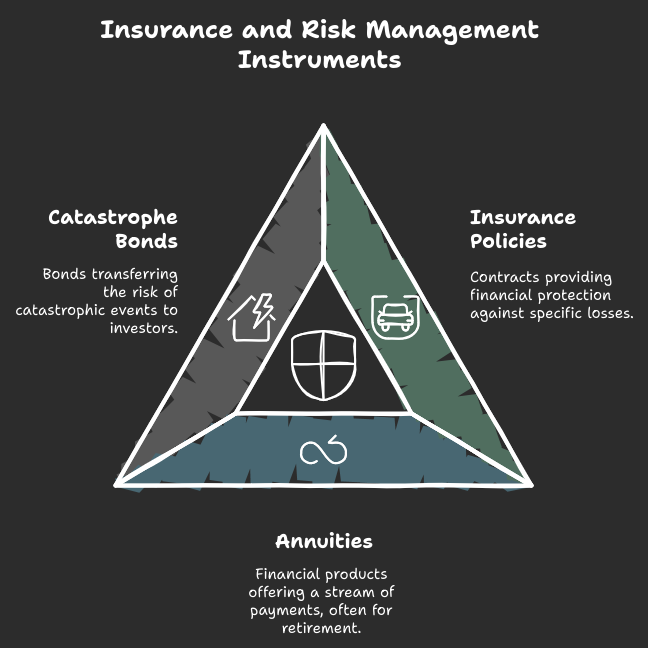

6. Insurance and Risk Management Instruments

- Insurance Policies: Contracts that provide a payout to offset losses in specific scenarios (e.g., life, health, auto, property insurance).

- Annuities: Financial products typically offered by insurance companies that provide a stream of payments, often for retirement.

- Catastrophe Bonds: Bonds issued by insurers to transfer the risk of catastrophic events to investors.

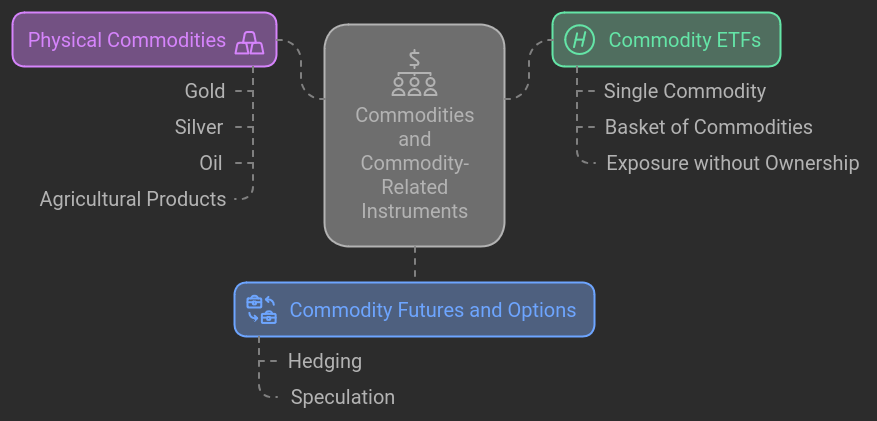

7. Commodities and Commodity-Related Instruments

- Physical Commodities: Actual goods like gold, silver, oil, agricultural products.

- Commodity Futures and Options: Derivative contracts based on commodity prices, used to hedge or speculate on commodity price movements.

- Commodity ETFs: Funds that track a specific commodity or a basket of commodities, offering exposure without direct ownership.

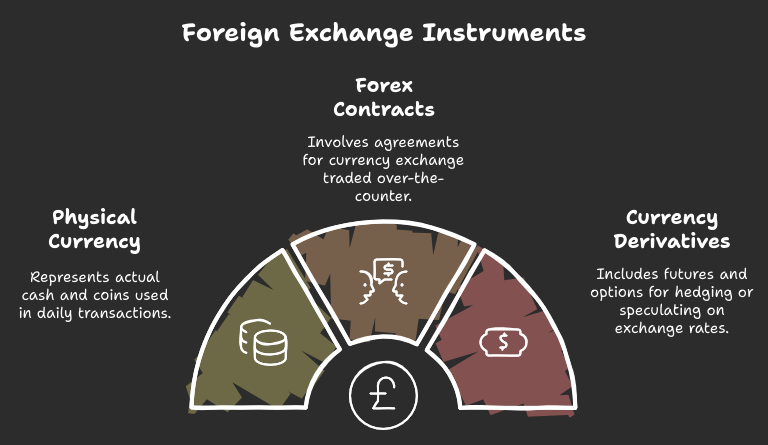

8. Foreign Exchange Instruments

- Currency: Actual physical currency and cash.

- Forex (Foreign Exchange) Contracts: Contracts for exchanging one currency for another, traded over-the-counter.

- Currency Futures and Options: Derivatives that allow investors to hedge or speculate on currency exchange rate changes.

9. Real Estate and Real Estate-Related Instruments

- Real Estate Investment Trusts (REITs): Companies that own, operate, or finance income-producing real estate, and offer shares to investors.

- Mortgage-Backed Securities (MBS): Securities backed by a pool of mortgages, allowing investors to invest in real estate without owning property directly.

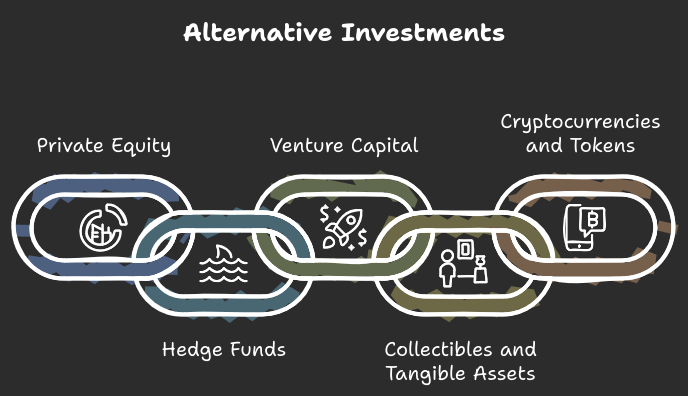

10. Alternative Investments

- Private Equity: Investments in private companies or buyouts of public companies, generally held by institutional or high-net-worth investors.

- Hedge Funds: Pooled funds that employ various strategies, including leverage, derivatives, and short-selling, typically for high-net-worth investors.

- Venture Capital: Investments in early-stage companies or startups, usually involving a high risk-return profile.

- Collectibles and Tangible Assets: Physical assets like art, wine, stamps, or coins that may appreciate over time.

- Cryptocurrencies and Tokens: Digital assets on a blockchain, such as Bitcoin or Ethereum, as well as tokens representing ownership or utility.

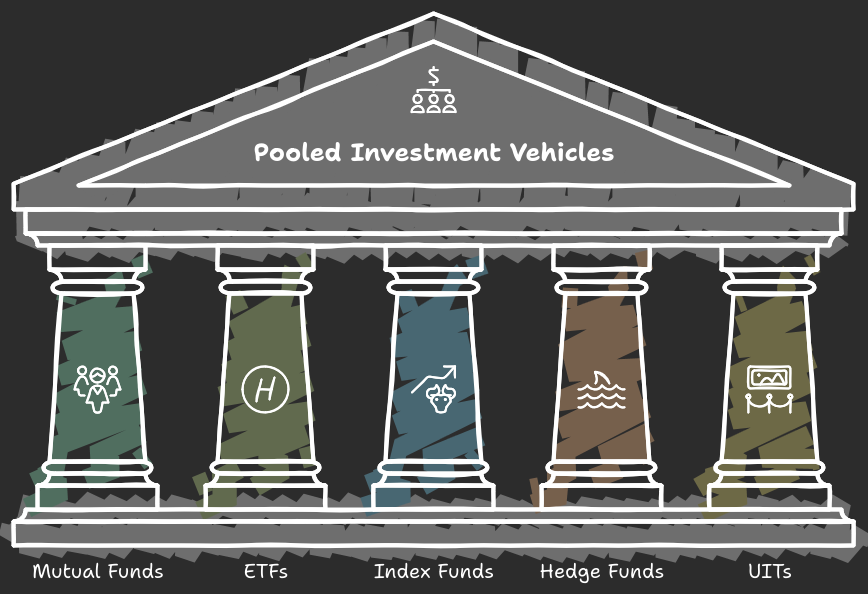

11. Pooled Investment Vehicles

- Mutual Funds: Pooled investments managed by a fund manager that invests in a diversified portfolio of stocks, bonds, or other securities.

- Exchange-Traded Funds (ETFs): Funds that track an index, commodity, or sector and are traded like stocks on exchanges.

- Index Funds: Passively managed funds designed to replicate the performance of a specific index, like the S&P 500.

- Hedge Funds: Pooled funds that may use high-risk strategies, available to accredited investors.

- Unit Investment Trusts (UITs): Pooled investments in a fixed portfolio of assets for a set period.

Share The Wealth

Are you familiar with all of these financial instruments? Was this helpful? Let me know in the comments below!