Another heated topic on social media is how to manage risk in a stock portfolio. It seems far too many people have a binary mindset when it comes to investing. They are either fully invested in stocks or they are fully out sitting on cash. There are alternatives to those binary modes. Below is a list generated with the help of AI to help you manage risk in your stock portfolio. I use many of these tools to help manage my portfolio and write about them here occasionally. Here’s a comprehensive list of approaches to risk management:

1. Diversification

- Portfolio Diversification: Hold a mix of assets across different sectors, industries, and geographies to spread risk and reduce the impact of a decline in any single stock or market.

- Asset Class Diversification: Consider including bonds, commodities, or real estate in your portfolio, as these often have different risk-return profiles than equities.

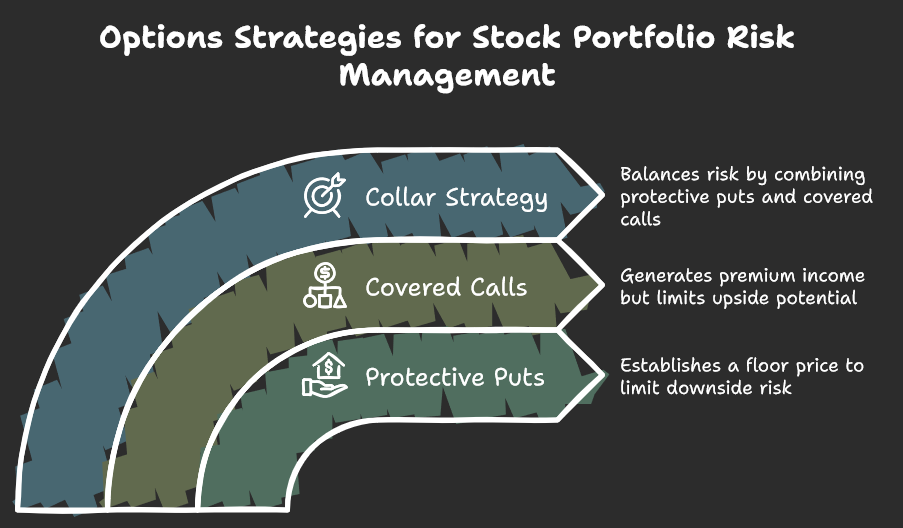

2. Hedging with Options

- Protective Puts: Buy put options on the stock to establish a floor price. This allows the stockholder to sell at a predetermined price, limiting downside risk.

- Covered Calls: Sell call options on the stock. This generates premium income that can offset small declines in the stock’s value but requires selling the stock if the price exceeds the strike price.

- Collar Strategy: Combine a protective put with a covered call. This limits both the upside and downside, providing a more balanced approach to risk management.

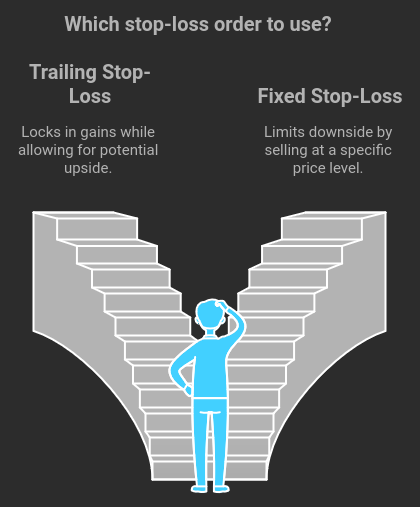

3. Trailing Stop-Loss Orders

- Trailing Stop-Loss Orders: Use stop-loss orders that adjust as the stock price rises, locking in gains while still allowing for potential upside. For example, a 10% trailing stop will trigger a sell if the stock drops by 10% from its peak.

- Fixed Stop-Loss Orders: Set a fixed stop-loss at a specific price level to automatically sell the stock if it falls to that level, limiting the downside.

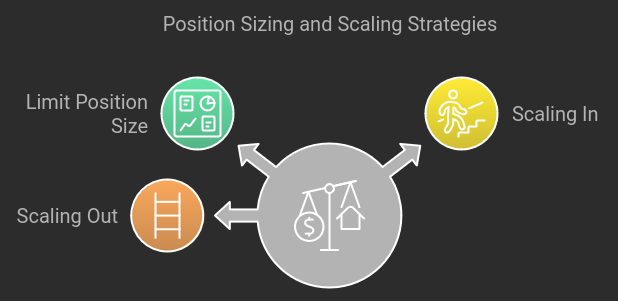

4. Position Sizing and Scaling

- Limit Position Size: Avoid concentrating too much capital in a single stock by setting a maximum allocation per stock, such as 5% of the portfolio. This limits exposure to any one position.

- Scaling In and Out: Enter a stock position gradually to average the purchase price over time. Similarly, scale out of a position to secure profits and reduce exposure incrementally.

5. Sector or Market Hedging

- Inverse ETFs: Use inverse exchange-traded funds (ETFs) that move opposite to the market or sector in which you hold stocks. For example, if you hold technology stocks, you might buy an inverse tech ETF during uncertain periods.

- Index Puts: Buy put options on the overall market index (like the S&P 500) if your stock is highly correlated with it. This can act as a broad hedge against market declines.

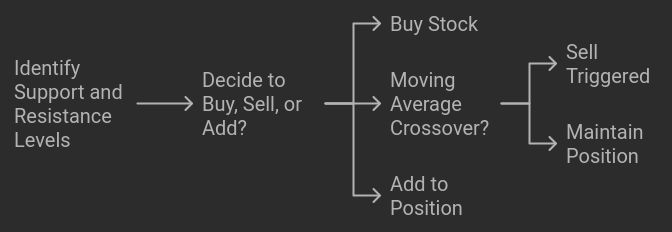

6. Technical Analysis for Entry and Exit Points

- Support and Resistance Levels: Use technical analysis to identify critical support and resistance levels, helping decide when to buy, sell, or add to a position.

- Moving Averages: Set sell triggers based on moving average crossovers, such as when the 50-day moving average crosses below the 200-day moving average, which can indicate potential declines.

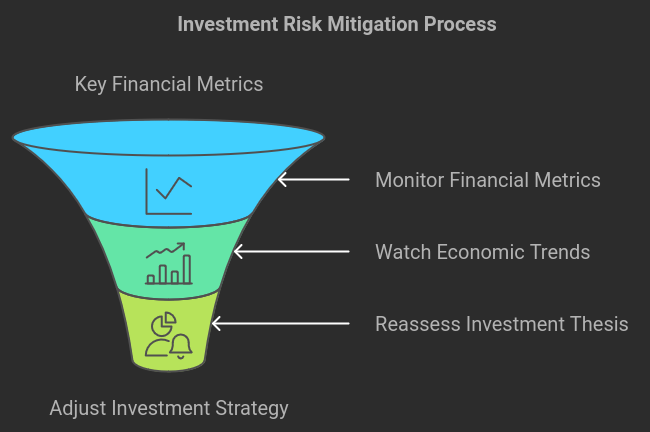

7. Fundamental Risk Monitoring

- Monitor Key Financial Metrics: Track revenue, earnings, debt levels, and other key metrics. Sell or hedge the position if these metrics deteriorate.

- Watch Industry and Economic Trends: Stay updated on broader economic indicators and trends in the sector. If there’s a clear industry downturn, consider reducing exposure.

- Reassess the Investment Thesis: Regularly review the original reasons for holding the stock. If the reasons change or no longer hold, consider selling or hedging.

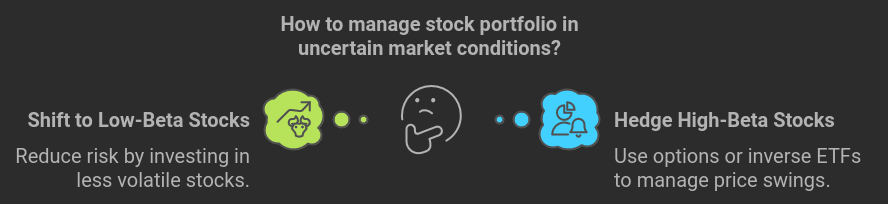

8. Using Beta to Adjust for Volatility

- Low-Beta Stocks: If the market outlook is uncertain, consider shifting toward stocks with low beta (less volatile than the market), which may reduce risk.

- Hedging High-Beta Stocks: For high-beta stocks (more volatile), use options or inverse ETFs to manage potential price swings.

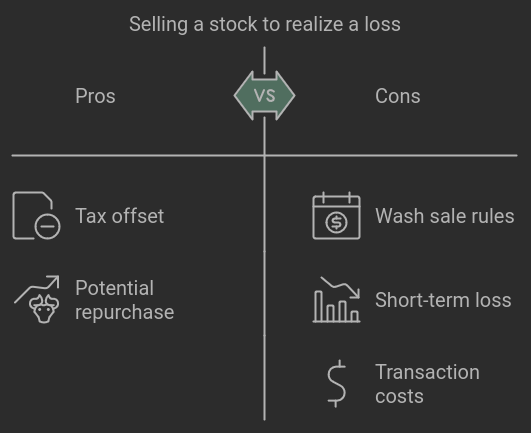

9. Tax-Loss Harvesting

- Sell to Realize Losses: If a stock position has declined in value, consider selling it to realize a loss, which can offset other capital gains and reduce tax liability.

- Rebuy Later if Desired: After observing any applicable wash sale rules (often a 30-day period), consider buying the stock back if you still believe in its long-term potential.

10. Consider Dollar-Cost Averaging (DCA)

- Gradual Investment: Instead of buying the entire position at once, gradually purchase shares over time. This reduces the impact of short-term price volatility and averages the purchase cost.

11. Long-Term Perspective and Patience

- Ride Out Volatility: If holding a high-quality stock with a strong long-term outlook, sometimes the best strategy is to ignore short-term fluctuations and maintain a long-term focus.

- Dividends and Reinvestment: For dividend-paying stocks, reinvest dividends to accumulate more shares, which can reduce the average cost per share over time.

12. Consider Professional Management or Advice

- Advisors and Portfolio Managers: A financial advisor or professional portfolio manager can offer strategies for managing risk and helping tailor a strategy to personal financial goals and risk tolerance.

- Managed Funds or ETFs: Investing in managed mutual funds or ETFs provides instant diversification and professional oversight, which can reduce individual stock risk.

Each of these strategies provides a different way to manage the risk associated with holding a stock equity position. Often, a combination of these techniques can create a robust risk management approach tailored to specific goals and risk tolerance.

Share The Wealth

Many of the things on this list I use daily and share with readers, next time I do I will reference this page but tell me what you think. Let me know in the comments below.