There are many ways to hedge an investment portfolio especially if you have a majority of your investments in the U.S. market and indexes such as the S&P 500. One of my occasional tools is to hedge my portfolio through purchases of FXF or it’s related options.

SPY vs FXF Divergences

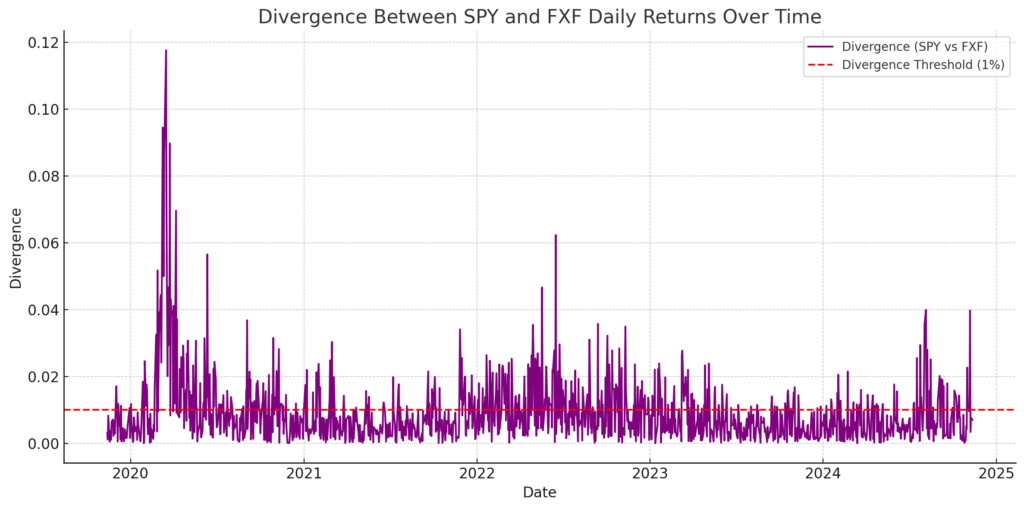

I asked AI to give me a chart of divergences between SPY (S&P 500 ETF) and FXF (Swiss Currency ETF) and it produced the chart below.

Major Events – Major Divergences

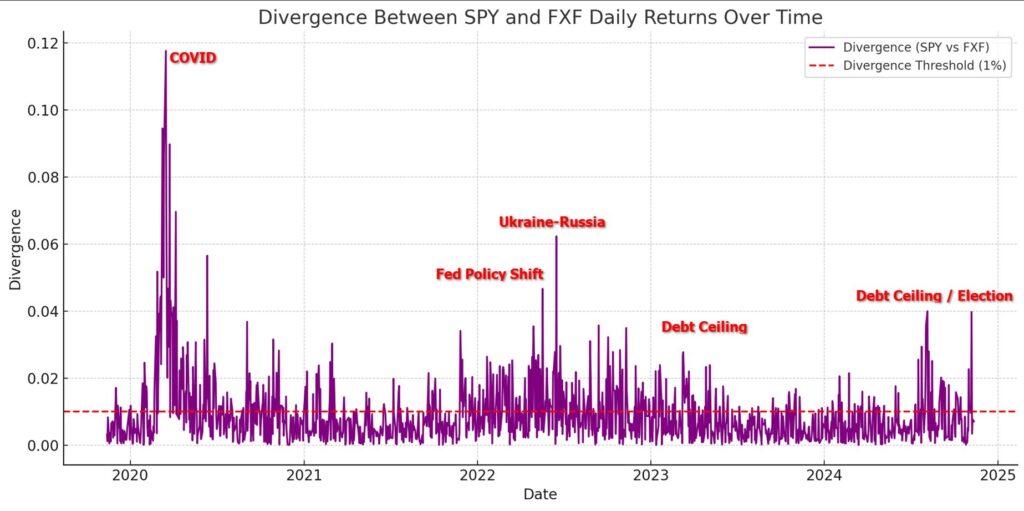

I then asked AI to give me the major events during these periods and here is what it popped up.

To identify significant events during periods of divergence between SPY (S&P 500 ETF) and FXF (Swiss Franc ETF), we can review historical dates where divergences were notable and correlate them with major economic, geopolitical, or financial events. Here’s an outline of events that might align with the divergence instances:

1. Trade Tensions and Tariffs (2018–2019)

- U.S.-China Trade War: Trade tensions escalated with rounds of tariffs on goods between the U.S. and China. Uncertainty affected the stock market (SPY) while safe-haven assets like the Swiss Franc (tracked by FXF) often saw inflows, causing divergence.

- Event Example: In December 2019, the “phase one” trade deal was signed, temporarily stabilizing tensions but causing fluctuations in the days leading up to and after the signing.

2. COVID-19 Pandemic (2020)

- The onset and global spread of COVID-19 led to extreme volatility. Stocks initially plummeted as markets anticipated the economic shutdowns, while the Swiss Franc saw periods of strength as investors moved to perceived safe havens.

- Key Divergence Points: March 2020 saw the largest market drops in decades, followed by fiscal and monetary stimulus announcements that led to significant daily fluctuations in both assets.

3. Federal Reserve Policy Shifts (2021–2022)

- Interest Rate Hikes: In 2022, the Federal Reserve began an aggressive rate-hiking cycle to combat inflation, impacting U.S. equities negatively while the Swiss Franc sometimes appreciated as a counter-currency.

- Divergence Example: High inflation reports or Fed meeting dates often corresponded to noticeable divergences due to market reactions to interest rate expectations.

4. Ukraine-Russia Conflict (February 2022)

- The geopolitical risk from Russia’s invasion of Ukraine prompted safe-haven flows. The stock market (SPY) was impacted negatively due to fears of economic fallout, while the Swiss Franc strengthened.

- Divergence Peaks: February and March 2022 were especially volatile, with SPY dropping significantly while FXF had smaller or positive returns.

5. U.S. Debt Ceiling Concerns (Recurring)

- Negotiations and standoffs over raising the U.S. debt ceiling, especially in 2021 and again in mid-2023, often led to heightened market volatility and safe-haven demand.

- Divergence Example: During periods of heightened fiscal uncertainty, SPY exhibited greater volatility compared to FXF, as investors anticipated potential economic disruptions.

AI left out the election which I’m certain created some flight to safe haven Swiss currency and the divergence is currently elevated so something may be brewing somewhere and we’re just not aware yet.

I have taken a small position on FXF as of the time of this post and will build on it if markets deteriorate.

I am grateful for AI helping me do this research in a matter of seconds, including creating the charts except I had to download some of the data myself and upload it to AI, it saved me hours of work!

Share The Wealth

How are you hedging your portfolio and have you asked AI if it’s a good idea yet?

1 thought on “Using Swiss Currency To Hedge Your Investment Portfolio”

Comments are closed.