I have been using Boldin software now for a couple of months and felt it was a good time to write a review about it. You can visit their website at www.boldin.com.

Cost

I’ll get to the cost part first because it’s one of the easiest things to discuss and what most people are generally concerned about when acquiring software. Boldin has three tiers: Free, $120/year, $1650/year (for advisors).

I tried the free plan and liked it so much that I jumped on the “PlannerPlus” annual subscription to try it out for a year. At $120/year, I think it’s reasonably priced and generally a good value for the current capabilities.

Functionality

If you’d rather not read endless text about the software, the best thing to do is simply watch a YouTube video of someone that goes through the software.

I will focus on some key things that I like and don’t like though.

What I like

Overall, the software does a great job in taking your data inputs, analyzing the data and spitting out reports. I really like the scenario planner which allows you to change different monetary inputs and outputs to let you know how much better or worse off you’ll be.

I like that you can separate your spouses finances from your own but they could do a better job in creating separate scenarios for couples that manage finances separately than jointly.

I like the categories it covers for retirement including: Goals, Accounts & Assets, Home & Real Estate, Income, Money Flows, Debts, Healthcare & Expenses, Estate Planning, & Rate Assumptions.

There is a great section on Milestones such as Retirement Age, Medicare, Social Security, etc.

Connections allows you to connect data feeds from your financial institutions but I am not using this feature because I don’t trust that my data won’t be hacked.

There is a “coaching” feature that give suggestions to strengthen plan and some To Do’s to follow up. There is also a wellness feature with some good metrics such as saving rates, total debt ratio, and cash flow.

Insights provide a library of things to be concerned about or focus for retirement such as IRMAA, Retirement Withdrawals, Taxes, and many more.

According to the software, I have a 99% chance of a successful retirement and never running out of money and leaving my beneficiaries a few million dollars when I die.

What I don’t like

Perhaps I’m asking too much of a software app but I don’t like how recurring expenses are entered and tracked in the app. It would be a great addition to add AI functionality that could import a credit card statement and simply fill out most of my expenses. Manual data entry is always the bane of any system!

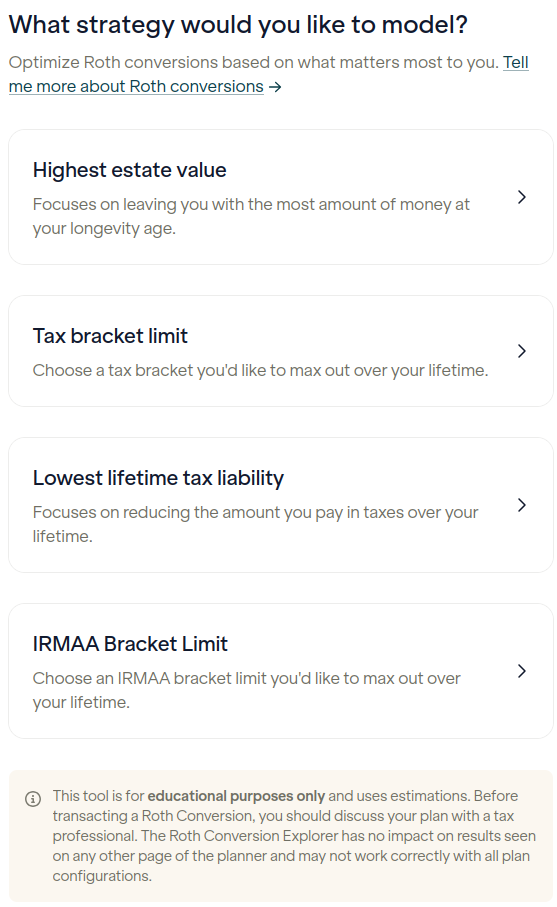

I like the Roth Conversion Explorer however a better job could be done in walking a user through the options.

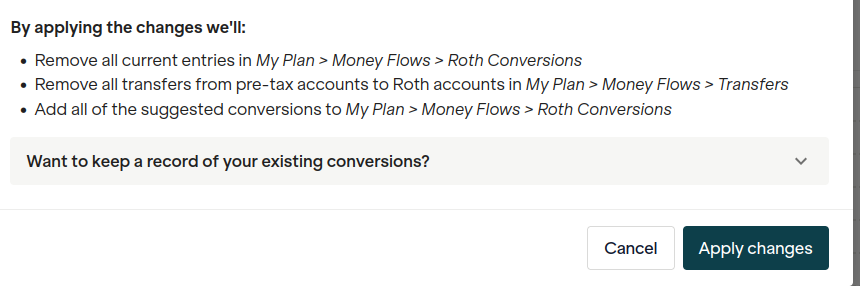

I’ll need to watch some training videos on all the options and impact in each of these options because the information, charts, and graphs weren’t always informative enough on what I was looking at such as the image below from one scenario. The ominous warning makes it seem like I’m going to destroy something in my scenario.

Lastly, I don’t like that medicare and social security aren’t treated as importantly as they are in retirement. I love the IRMAA planning but there is nothing else around the complex medicare plans and costs and how to optimize social security.

Conclusion

There really isn’t anything affordable in the software retirement market right now. I wrote a post about all the software available to financial advisors but many of the applications are for advisors only and cost thousands of dollars.

Boldin is a great low cost option that gets you 80% of the way to retirement planning. The missing 20% will require a CPA, a fee based financial advisor and a specialist in medicare and social security to complete a full plan.

I am using the software and I do recommend it.

Share The Wealth

Are you using retirement planning software? Let me know in the comments below!