One of the most annoying questions I see on websites like Finance.Yahoo.com ask something like, “I have $5 million dollars, can I retire now?”

It’s an annoying question because the answer is always going to be the same: it depends. If you have a $100,000/month shopping habit, then $5 million may not be enough to last you the rest of your life unless you know you’re going to die in a few years. Alternatively if you get by on $40,000 per year then you’re probably good for the next 40 years.

I’ve been contemplating how much money I really need to retire comfortably. The obvious advice you’ll get from most financial advisors is to tally up your expected expenses on a monthly or yearly basis and compare it to your expected income from your investments and government support like social security.

While this advice is ok, I’ve never felt truly comfortable with it because it leaves one key thing out: my peers. No, this isn’t a “keep up with the Joneses” idea but the Joneses do impact the inflationary environment.

Median Income

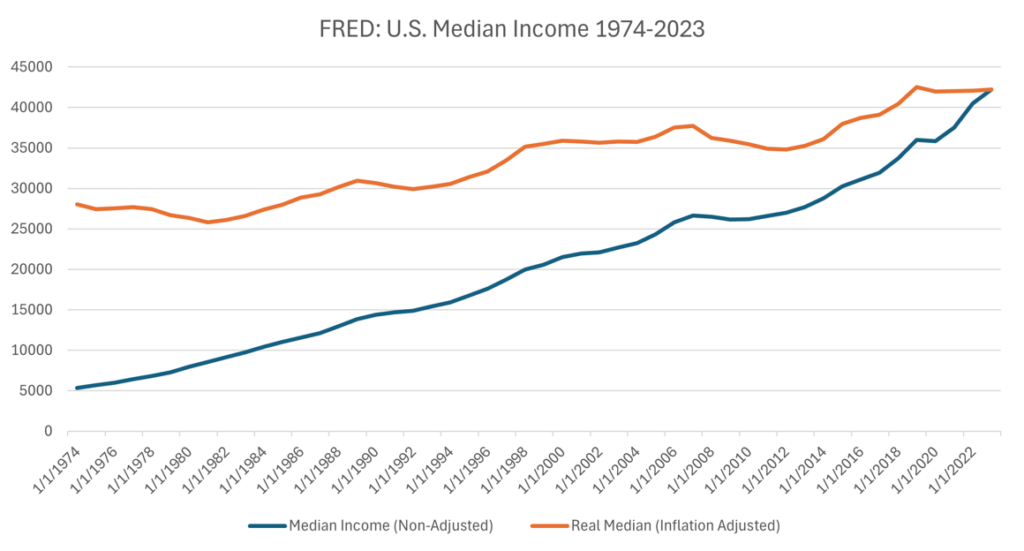

I decided to use my favorite FRED tool and pull data on historical median income in the U.S. The codes, if you’re interested in pulling your own data are MPAINUSA46N and MEPAINUSA672N.

My thesis here is that in order to truly have a comfortable retirement, the income your investment and social support programs must generate must be at least 20% higher than the median wage for that given year. So for 2023, the median inflation adjusted wage in the U.S. was $42,220 and if you double it for a couple then it’s $84,440.

If I want to be at least 20% over that amount then my investments must generate $101,328 for 2023. So what amount of money earning 8% return will that be? $1,2066,600.

The reason this logic makes more sense to me is because if I focus on simply managing my expenses today, I’ll have no idea what new expenses may come my way. Think about this, the iPhone was invented in 2007 and if you had retired in 2006 and hadn’t budgeted for that ever growing expense you would have been left out. ChatGPT was released in November 30, 2022 and it’s now transforming the world. What will the next 10 years bring?

So far, my wife and I have far exceeded the amount of money we need to retire using this perspective but we want to be absolutely sure we won’t run out of money so we’ll continue to look at our retirement from different angles, ideas and philosophies.

Share The Wealth

Are you thinking of retiring? What methodology are you using to make sure you’re ready? Let me know in the comments below.