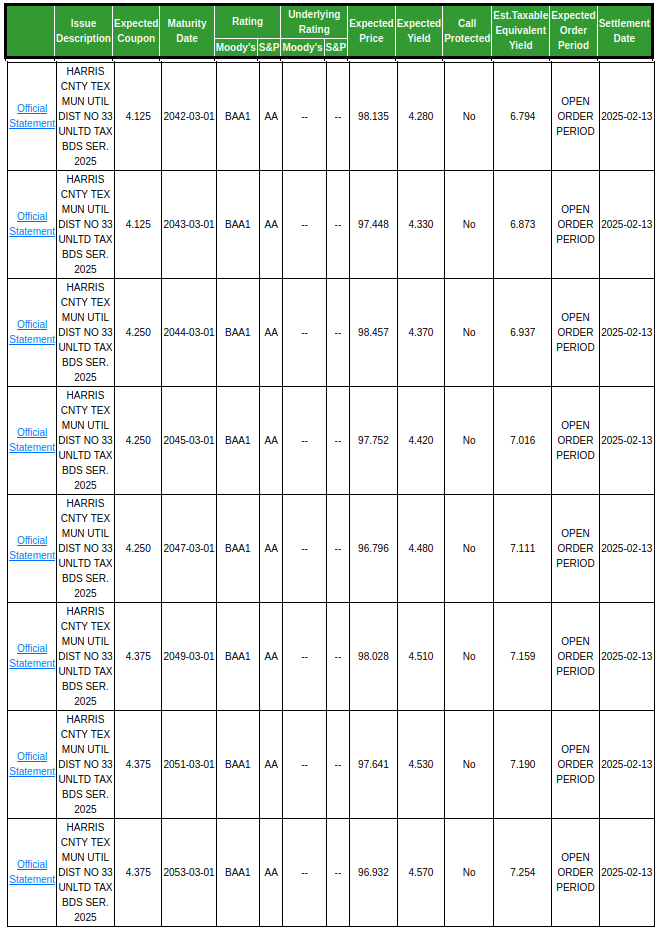

I’m giddy with excitement. I got an email from Fidelity on some new municipal bonds offering a whopping tax equivalent yield of 7.254 percent. The real yield is 4.57 percent but keep in mind that the interest is free from state and federal income taxes so the adjusted yield is equivalent to about 7.25 percent.

The Bad News

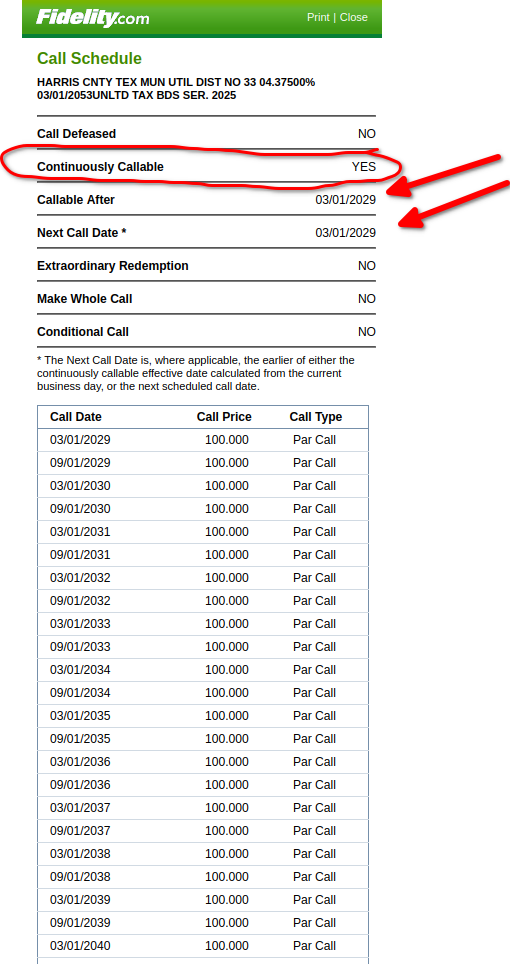

Of course, there is some bad news. These bonds are callable which means the issuing authority (Harris County) can buy back the bonds. The call schedule is below and the first call date is March 1, 2029 which means if you buy in 2025 you’ll get 4 years of interest at the tax equivalent yield of 7.25. Not bad and it’s better than a CD (for me) since it’s tax free.

I did put in an order to buy the minimum which is $5,000 and I will keep an eye out for more. I bought these bonds in my taxable account and since the interest is tax free, I won’t be paying taxes on interest.

I am now carrying about $50,000 in munis across numerous accounts and I’ve been waiting for a surge in interest rates to buy more. I do expect interest rates to remain high and likely go higher over the next couple of years so it’s important to pace my purchases.

Share The Wealth

Are you loading up on these juicy tax free yields? Let me know in the comments below.