I wanted to write a series of posts on a full life-cycle of a covered call transaction with these posts but the volatility in the market is making too many opportunities for me to use my standard methodologies. To that end I took the opportunity to sell more calls on IWM and rake in $700 with a potential upside of $7000 in profits.

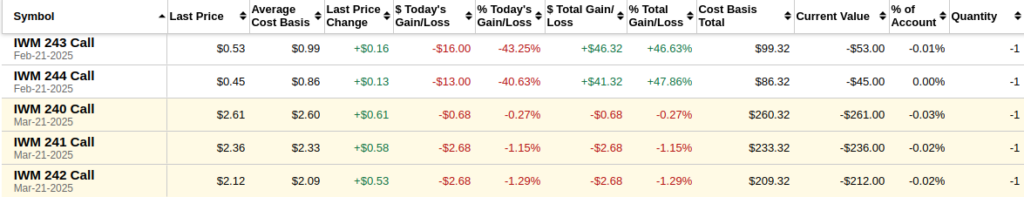

I sold $240, $241, and $242 calls after buying them back a few days ago. The premium I collected is about $700 but I will buy them back at 60% to 80% profitability so that may go down to $420 to $560. Alternatively, if IWM rallies hard, I’ll be capped out at $7000 in profits.

Rinse & Repeat

The process here is to hold IWM long term, collect dividends and then make additional income by selling calls using a call ladder. I tend to do this on a variety of stocks and ETFs but IWM has large options volume so the premiums tend to be more profitable.

The great thing about this strategy is that it takes minutes to execute and collect the premiums/profits.

Disclaimer

As always, don’t copy someone on the internet. Do your own due diligence for your own investment strategy needs and consult with a professional, especially if you don’t know what you’re doing.

Share The Wealth

Are you selling covered calls on your stocks or ETFs? Let me know in the comments below!

1 thought on “Sold IWM Calls Today”

Comments are closed.