The premise of the new administration in office was that it would make inflation go away right away but inflation seems to be heading in the wrong direction. Inflation is my primary concern when I retire and with good reason, once someone begins to live off investments, they need to make sure they have enough money to pay for expenses.

I keep a key eye on inflation and I’ve written a few posts on it here, here and here. The BLS released their January 2025 inflation report which you can click through here but I’ve highlighted a few things below.

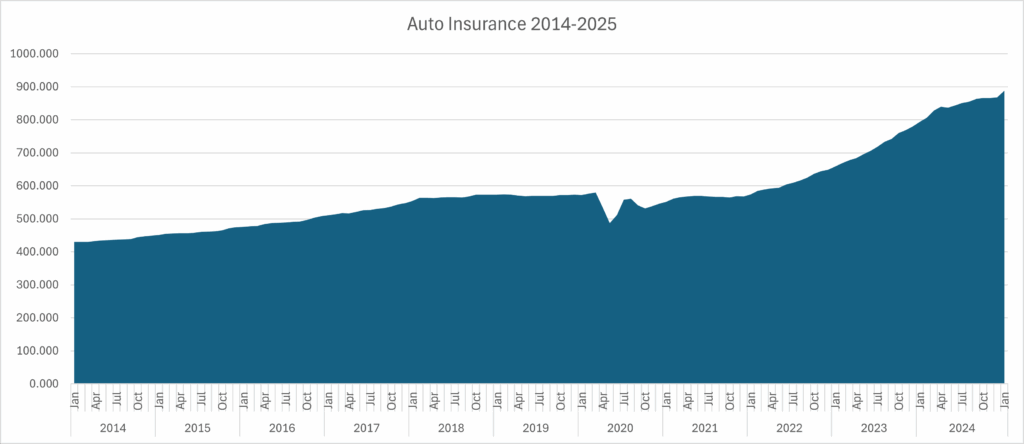

Auto Insurance

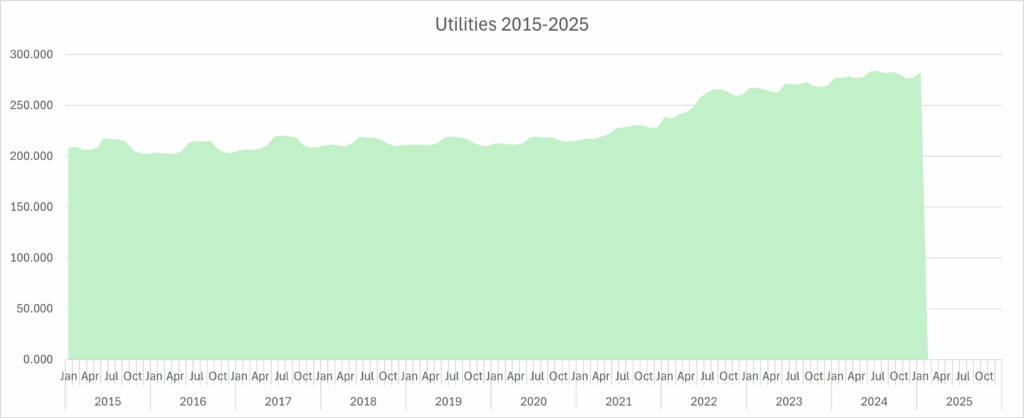

Utilities

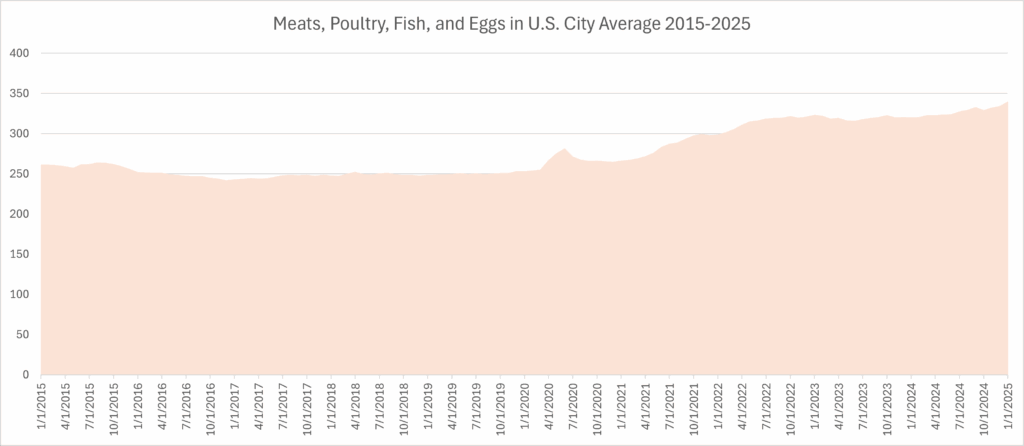

Meats, Eggs, Poultry

Food, utilities and insurance are all up so if you’re wondering where all your money is going, it’s to inflation. The sinister thing about inflation is that it’s death by a thousand little cuts because it can be so subtle and slow that unless you’re playing close attention you won’t know what’s happening to your money.

Share The Wealth

Is your money getting eaten up by inflation? Let me know in the comments below.

We bought solar panels in 2016. They were $16,000 after some government rebates. We’ve produced 88910 kilowatts, which, if my math is correct, means we have paid $0.18 Kwh, for the energy we’ve produced over that time.

In Rhode Island, the cost of energy is around $0.29 Kwh nowadays. We paid more upfront (money that could have been invested), but it’s paying off now. They are rated to be very efficient for 25 years, so as long as they are mostly maintenance-free we’ll do quite well in fighting energy inflation.

I’ve looked into solar panels but I’m at 0.13c/kW and didn’t make sense but I’ll keep an eye on inflation.