I am traveling and while I am away, I am not oblivious to what’s been happening with the stock market. I checked in this morning to see the status of my IWM collar. In case you missed it, here is a post from March 11 about how I planned on protecting my portfolio with an options collar strategy.

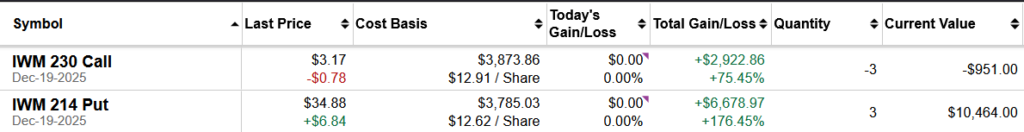

As of this morning, before market open, I captured a screen shot of my position.

I originally sold IWM 230 calls for December 19 expiry for $12.91 ($3,874) and those contracts are now worth $0.78 ($951). I am strongly tempted to buy them back and may do so sometime today to bank the 75% return largely because I don’t think IWM will stay low and I can re-sell calls again as it rises but I could be wrong.

The PUTS I bought with the call premium for $12.62 are now worth $34.88 but I won’t be selling these because these are my insurance policies against losses. If IWM remains below $214 in December 19, my “losses” will be limited by my put option right to sell it at $214 even though it’s trading at $181 as of today.

This is just one slice of one trade on a large diversified portfolio so let me tell you about one more.

Back in November 2024, I also bought Swiss currency as a hedge against losses on the USD. That trade is up 4.6% while the stock market losses continue to mount. It’s not a fabulous return and that was not the purpose, the purpose was to limit losses and I have none with this investment.

During that same time frame I purchased EURO currency and that trade is up 4.3% so far. This was another hedge diversified from the Swiss and US Dollar to hedge. I have family that lives in Europe and have other uses of this currency but it’s all part and parcel to the overall investment portfolio strategy.

UPDATE: I did end up closing the call position around $2.35 and banked over 80% profit. If IWM rallies in the near future, I will sell more calls, if not I will just keep my protective puts.

Share The Wealth

Are you panicking or did you have hedges in place to keep your cool in this volatile market? Let me know in the comments below.