I’ve been writing about municipal bonds lately largely because I love the tax free interest these bonds generate and it helps with taxes so I’m writing about munis yet again. This time I am going to write about my decision making process for which bonds to buy. Lately, I am getting a flood of municipal bond notifications from Fidelity. Here are some examples:

The municipal bond offering of $40,000,000 FLORIDA HOUSING FINANCE CORPORATION, Homeowner Mortgage Revenue Bonds…

Balances from the competitive sale of $12,450,000 Williamson County Municipal Utility District No. 23, Texas, Unlimited Tax Road Bonds, Series 2024 are now available…

The municipal bond offering of $127,650,000 Alaska Housing Finance Corporation, State Capital Project Bonds II, 2024 Series A is now open and accepting orders…

Balances from the competitive sale of $20,800,000 Lawrence County, Tennessee, General Obligation Public Improvement Bonds, Series 2024 are now available for customers to place orders.

Balances from the competitive sale of $12,420,000 Harris County Municipal Utility District No. 390, Texas, Unlimited Tax Bonds, Series 2024 are now available for customers to place orders

So which one should I buy? For starters, read this post about the municipal bonds most likely to default before you do anything else but that’s just the starting point.

I will run through an evaluation process for two bonds I was interested into looking into because of their juicy tax equivalent yields.

Wilson Bond

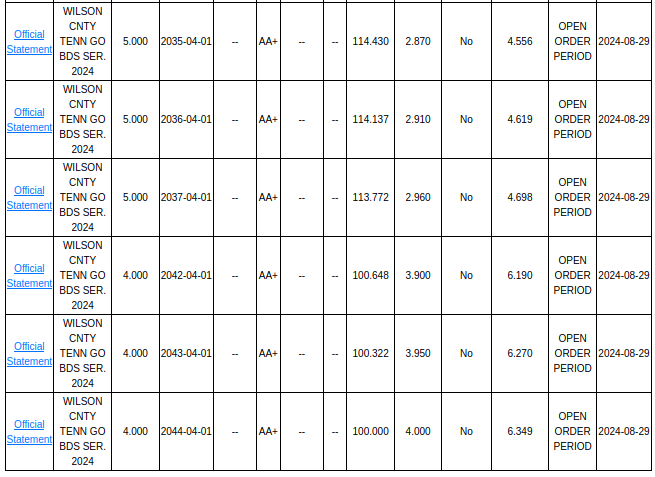

The table below I received from Fidelity and it shows a county general obligation bond from Wilson County in Tennessee.

Diana Bond

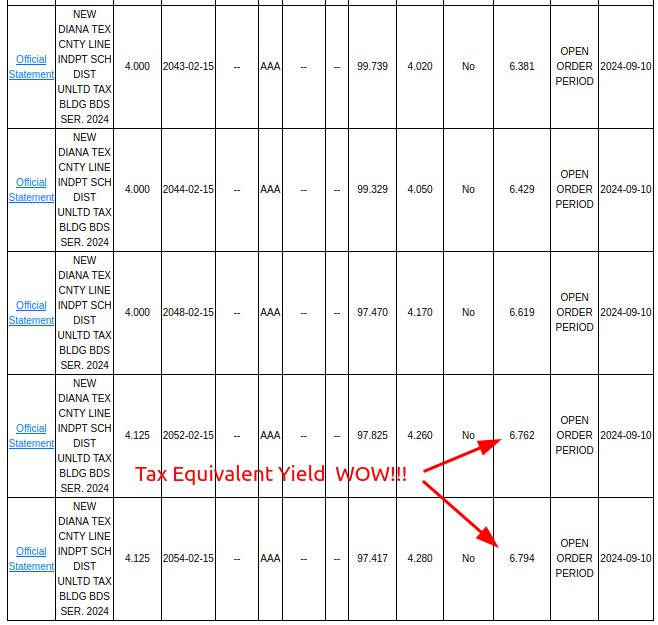

The table below I received from Fidelity and it shows a school bond from Diana Independent School District in Texas.

The tax equivalent yield on these bonds was 6.3% and 6.8%, respectively. So should I just buy the one with the higher yield? Well not necessarily.

The main concern I have with purchasing any bond is default. I want to be paid my promised interest and the return of my principal at the end of the bond period. What I look for when researching these bonds are data points that provide insights into the likelihood of default based on key metrics around demographics. Ultimately, it’s people that issue the bonds, it’s people that pay the taxes and it’s people that repay the loan or default. Essentially, I want to know as much as possible about the “people” taking on this debt the same way you might evaluate a deadbeat family member, friend or other person asking for money.

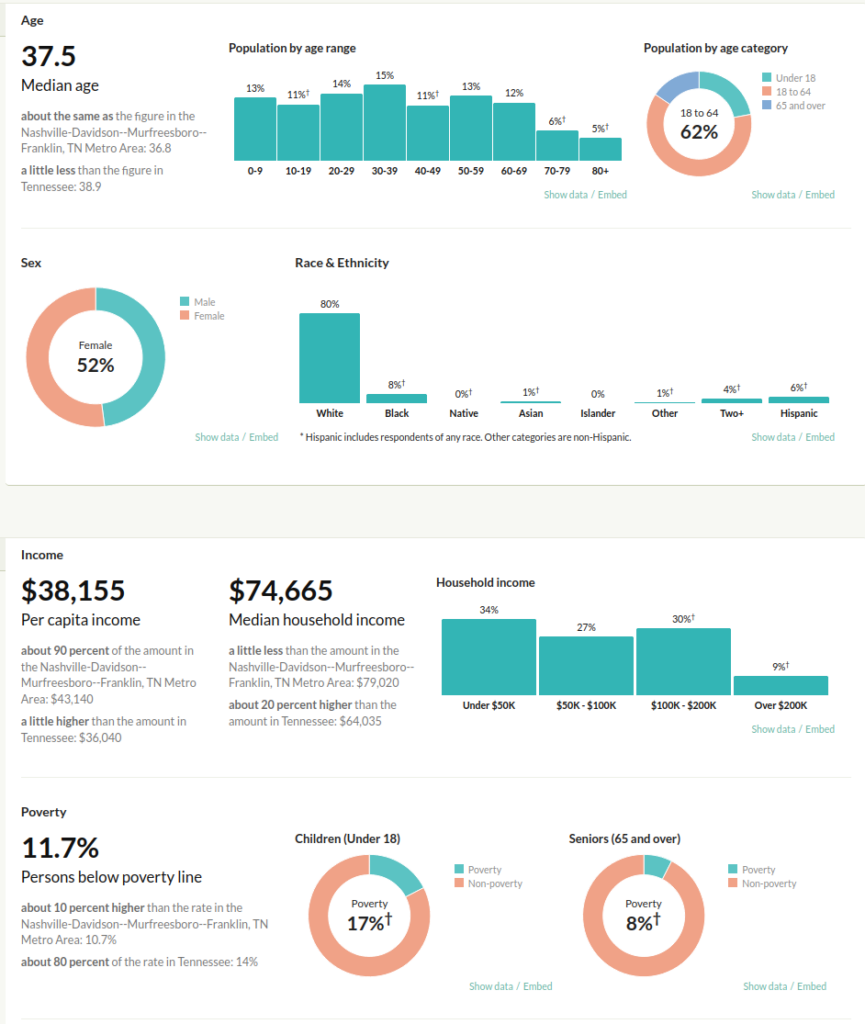

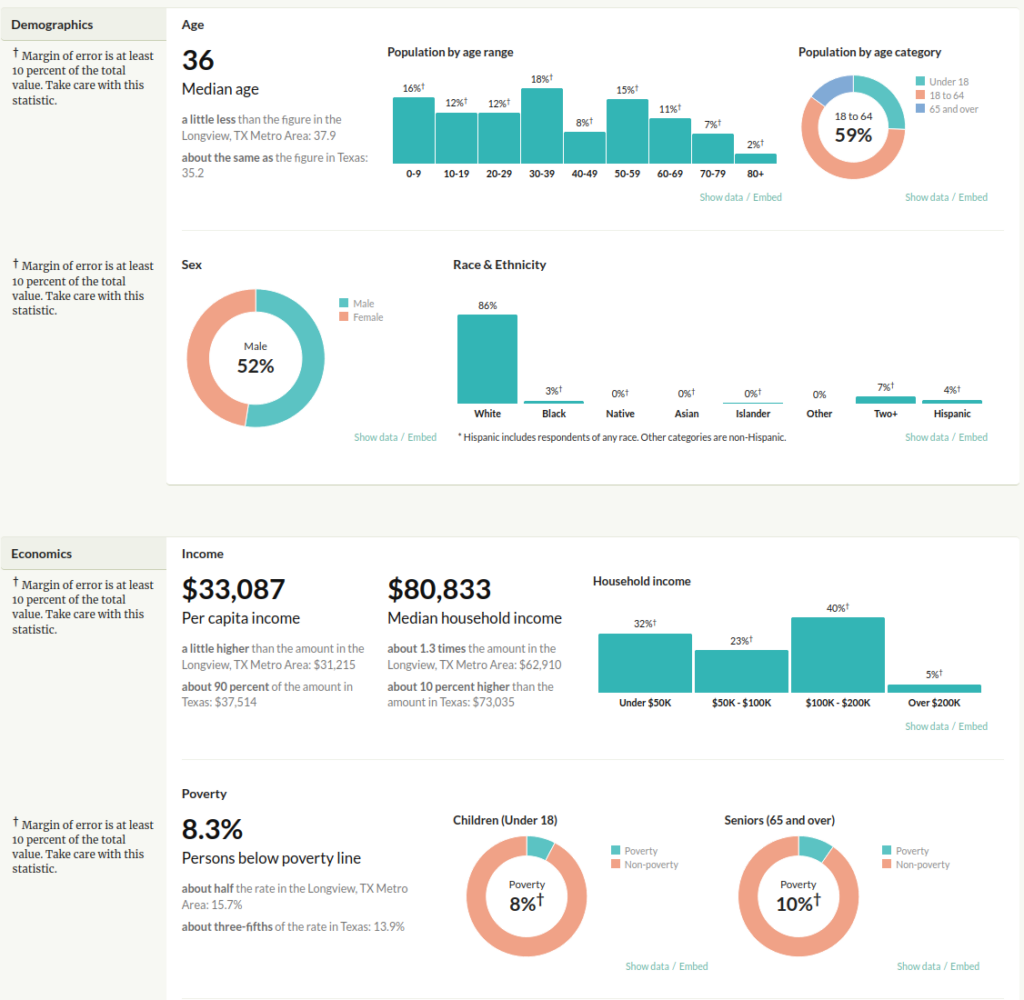

Wilson Stats

Below is an image from some demographic information about Wilson County. The median age is 37.5, which is good because a younger population at this age group will definitely keep working and paying taxes. The median income is decent but the per capita income doesn’t give me a warm fuzzy.

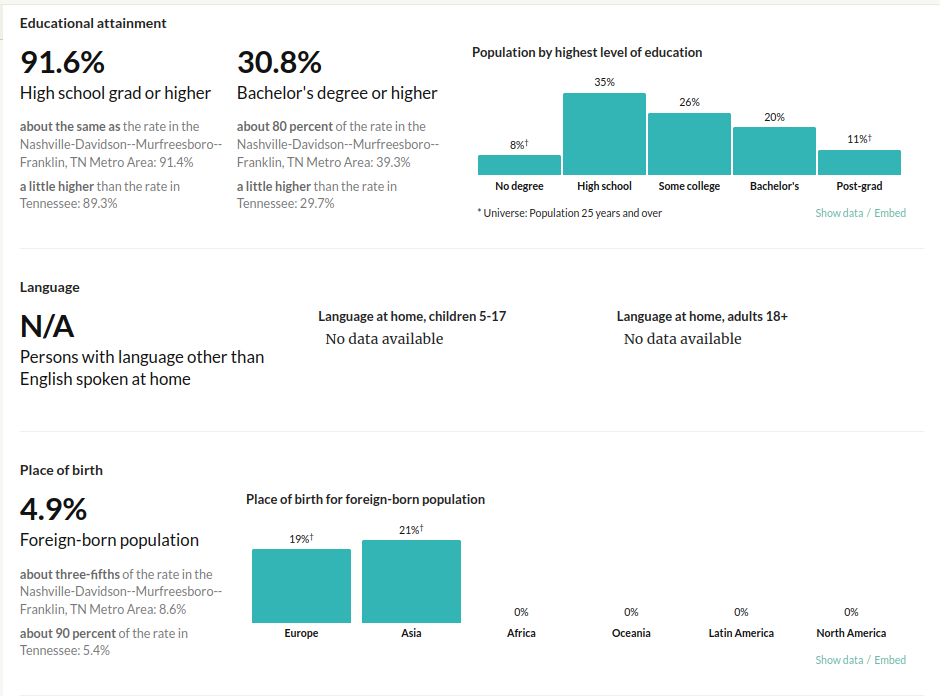

Wilson County has a 31% population with a college degree which provides for better income and job prospects over Diana ISD. The poverty level at 11.7% is higher than Diana but fairly low.

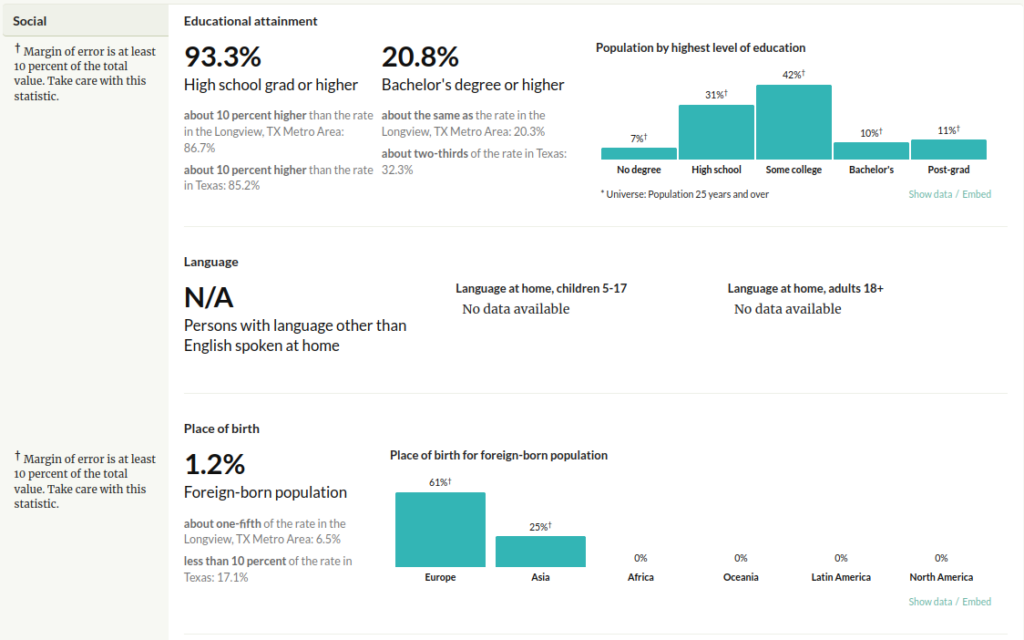

Diana Stats

Diana ISD has a younger age group with a median age at 36, higher median income at $80,833 but lower per capita income. Only 20% of the population is college educated vs Wilson Country but the poverty level is lower than Wilson.

Many More Data Points

There are many more data points that can be gathered about the district/city/county/state but I’m not going to post all of them here otherwise this would be a 20 page post. The key is to decide what is important to you in terms of “quality” borrowers when lending your money out. One of the more critical data points is if the population of the area is growing both in terms of population and business growth that will add to the tax base and tax revenue.

It’s important to build a tool with decision making and weighting systems to come up with a comprehensive score. Perhaps I might post the spreadsheet I use to do this if there is interest.

So which one did I buy? Neither. I already have far more municipal bonds than I was planning on buying and I have now setup automatic weekly purchases of NEA because reviewing these bonds is very time consuming and it’s just easier to buy this municipal bond ETF.

I expect the Fed to start cutting rates soon but I also expect rates to shoot back up next year when inflation spirals out of control again. When that happens, municipal bonds rates will be higher and I will be back to buy more.

Share The Wealth

What methodology do you use to research municipal bonds? Let me know in the comments below.

1 thought on “Evaluating Municipal Bonds”

Comments are closed.