“Doing the same thing over and over again and expecting different results is the definition of insanity.”

That’s a quote that I’ve had to use several times over the last month with a few different people on a few different topics so now I’m writing a post about it.

But first let’s talk about Escape Velocity.

Escape Velocity

Imagine a boy outside throwing a rock up into the sky hoping the rock flies out into space and perhaps to another planet. Obviously, the rock will shoot up then fall right back down. It won’t matter how many times the rock is thrown into the sky, it will always come down unless it is shot up with the right escape velocity of 11.2 km/s or 6.96 miles/sec from the very get go.

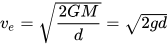

The formula for escape velocity is

The main variables here are gravity, mass and distance which you can read about in the link above. The stronger the gravity and the larger the mass, the harder it’s going to be to get off the ground and into space.

Financial Escape Velocity

Just like the boy throwing the rock up over and over again, there are too many people doing the same thing over and over again wondering why they aren’t taking off into space (financial freedom).

The way to deconstruct this problem and find a solution we need to start about the three variables keeping you locked in place.

There are parallels between the gravitational pull (which keeps an object tied to a planet) and financial obligations like debt, while sources of income, savings, and investments work similarly to the energy that helps one escape from financial constraints.

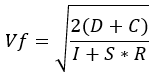

Let’s define variables that will represent the financial scenario:

D = Debt (total outstanding liabilities)

C = Cost of living (annual or monthly)

I = Income (annual or monthly)

S= Savings (existing)

R = Return on investment (rate of return on investments)

D + C = Total financial obligations, including debt and cost of living,

I + S * R = Financial resources, combining income and investment returns from savings.

The Debt and Cost of living are combined to represent the financial “pull” (similar to gravity).

Income and Returns from savings are the financial “thrust” that helps you escape the pull of financial obligations.

Financial Escape Velocity (Vf) represents how much financial power you need to generate relative to your obligations to be free from them. The lower the value of Vf, the closer to achieving financial freedom. If your income and investments outweigh your debt and cost of living, you are financially independent, and the formula’s result will approach zero or negative.

Is that it?

I know what you’re thinking, “okay great, I have the formula and the variables, is that it?”

Well no. All you have so far is a formula that tells you a numeric value that will show you if you’re ready to leave orbit (financial freedom) or not.

What you really need after understanding all those variables is a vehicle (investment accounts & plan & strategy), a team of engineers (mentors, advocates, sponsors), and sources of energy (income).

The size of your vehicle can vary, some people want a giant gold plated rocket ship others are fine with a two seat ship as long as it takes you far and away. Accordingly, the size of your engineering team and sources of energy will vary depending on your needs and wants.

The important thing is that you will need more than just yourself to make it happen. Throwing a rock up in the air over and over again hoping it makes it to orbit without changing anything won’t ever be a success.

You WILL need a rocket ship to get into orbit or gravity will always pull you back down. The ship won’t be built overnight and you won’t be able to do it alone but you have to start somewhere.

Share The Wealth

Have you built your rocket ship to escape orbit or are you building one? Let me know in the comments below.