Back on September 5th, I wrote a post about how to deal with stock market skeptics. In that post, I had opened a position by selling cash secured puts on SPY at $320 (fair value) strike price. I sold the put for $148 and was going to let it ride till December 20 at which point it would expire worthless or be assigned at $320 and I’d have to cough up $34,000.

73% Return

The value of the put has declined significantly which means my return has grown significantly. I decided to close out and pocket the 73% return and remove the $34k liability from my brokerage account.

The cost was $40 so I’m pocketing $100 in profits. Now, $100 may not sound like much but keep in mind that I have many other positions open so cumulatively, I earn anywhere from $4000 to $8000 per month doing transactions like this across multiple brokerage accounts.

So anyone that thinks the stock market is long over due for correction can still continue to invest in the market by selling puts on the equities they’d like to own but at the price they’re willing to pay through cash secured puts.

Puts go up in value when stocks go down and that’s the best time to sell them. When stocks go up in value, the puts decline in value so that’s a good time to buy them back.

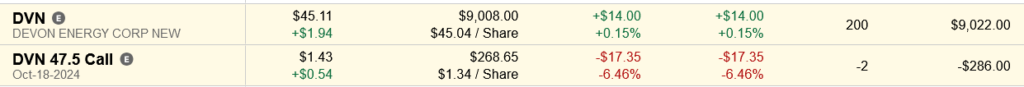

What about my other trade? I sold covered calls on DVN and the calls I sold have declined in value but I’m not ready to buy those back yet.

Note that I originally bought DVN at $45.11, sold the Oct 18 $47.50 strikes for $1.34. The calls are now worth $0.89 (42.69% return) and decaying in value rapidly since we are less than 1 month away from expiry. The good news is that it looks like I’ll be pocketing the dividend since I held the shares through the record date and the $0.22 dividend payout is on 9/30/2024.

Of course, DVN is trading at $40 resulting in a paper loss of $895 but I’m willing to hold DVN for the long term and sell more calls into the future for more premium and dividend.

I’ll write an update after expiry on DVN to see how well this transaction worked out.

Share The Wealth

Do you use cash secured puts or covered calls to add an additional income stream to your investment portfolio? Let me know in the comments below.