One of my favorite income generating strategies is to write covered calls on index funds. My favorite one to do this on is IWM. But what’s my approach & strategy?

I generally like to write covered calls 45 to 75 days out so I decided to share my strategy here for anyone interested however this is NOT trading or investment advice. It goes without saying that trading options has some level of risk and not recommended for most people. Do your own due diligence and contact a financial advisor before entering any kind of investment, especially if you don’t know what you’re doing.

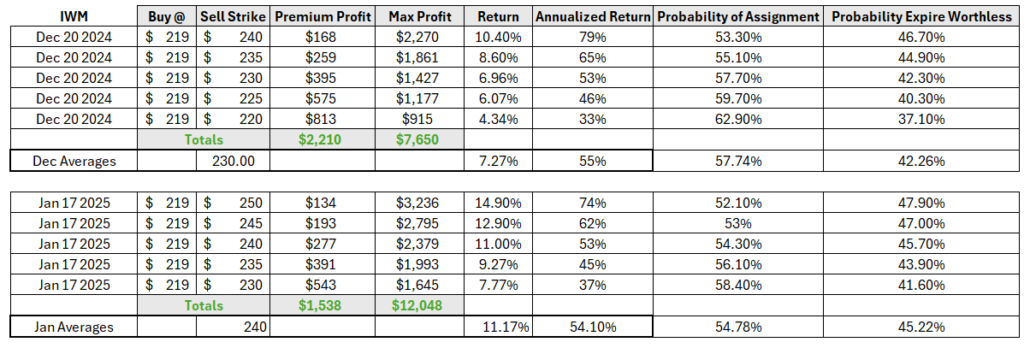

The table in the image above shows the December 20 and January 17 options premium and max profits at various strike prices. My general strategy is to ladder covered calls over various strike prices as I listed in each table. Premium profits are “banked” when you sell the call and max profit occurs if and only if the equity rises in value toward the strike price.

Strategy

The strategy in a nutshell is to execute 5 staggered buy-write trades on IWM. Assuming a purchase price of $219 and selling 1 contract at the strikes listed above.

Why stagger? I like to stagger the covered calls because I fully intend/hope that some of the calls get assigned and I cash out of the equity but I also want to stay in the equity until it reaches a higher price level. Of course, if the equity falls in value, I can buy back the calls and bank the profit then sell new calls further out into the calendar.

I like the January 2025 expiry window. I am looking to capture around $1500 in premium profit and potentially up to $12,000 in max profits. The end profits are likely to be somewhere above $1500 but below $12,000.

I won’t get into the statistical reasoning behind this on this post but I did include those probabilities in the table for reference in case anyone is wondering on the approach. Bonus points to any reader that can figure out the statistical framework.

Capital Intensive

In order to execute these 5 trades at $219, I will outlay $219 x 5 x 100 = $109,500 in capital. If I achieve max profits of $12,000 then the return would be 11% in about 74 days or 54% return annualized.

I won’t be entering any trades until after the election and the Fed’s FOMC meeting because markets tend to be highly volatile around those time frames but I do like to capture snapshots and scenarios beforehand. It’s entirely possible we have a market sell off too if the tariff candidate wins and creates mayhem in the markets in which case I will need to re-think all my trades.

Share The Wealth

Are you executing covered calls on index ETFs? Let me know in the comments below.