Last year in April I wrote two posts about a new ETF CPSM. The first was a brief description of how it’s supposed to work and the second was the actual purchase of this ETF. The premise of this ETF was that it would “guarantee” the core invested amount but yield a maximum of 9 percent at the end of the year. The actual amount of return would be based on what the underlying instrument, S&P 500, was trading at on May 1. This fund uses call and put options to set a fixed rate of return and offer downside protection.

Ironically, I bought it because I was worried about the market and that turned out to be a smart strategic move.

With 1 year upon us, I wanted to share how things panned out with this ETF and whether I’ll be renewing it or not.

As of the time of I’m writing this post, CPSM is trading at $27.10 and I bought it at $25.05 for a return of 8.18% which isn’t too bad. On May 2, I plan on selling this ETF and I would do it now except I want to avoid short term capital gains so I have to hold until May 2 to avoid it.

Upcoming Cap Range

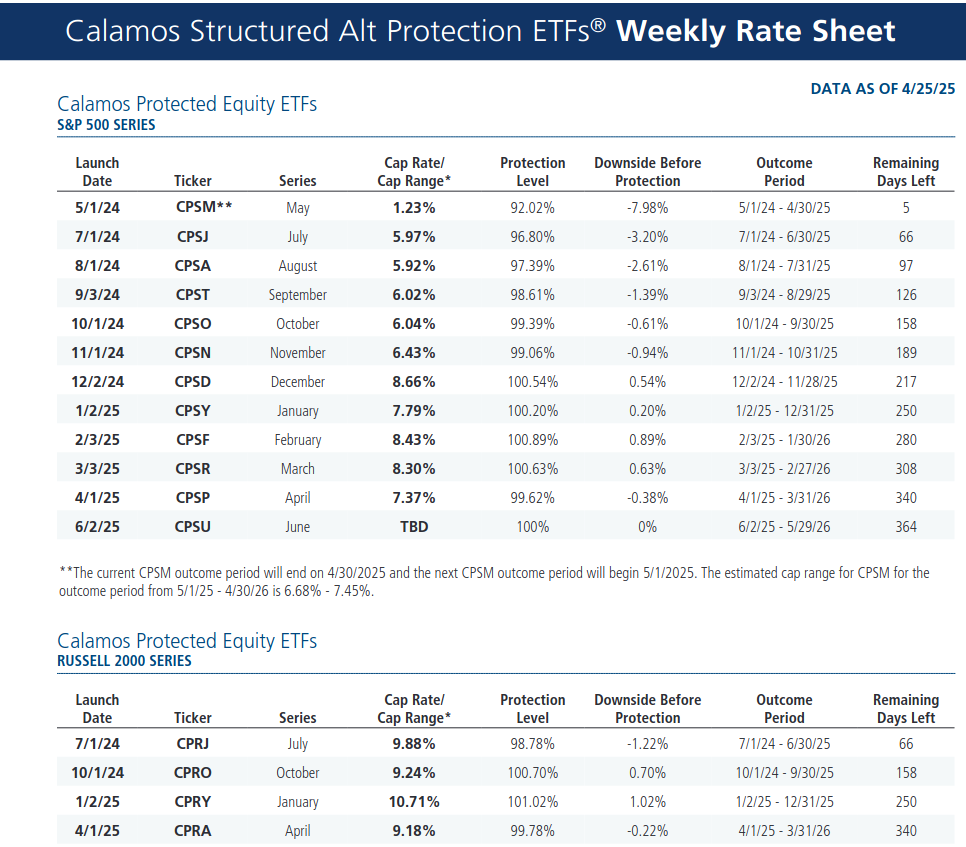

As you can see from the image above, the footnote on the upcoming cap range for CPSM is currently anticipated at 6.68% and 7.45% and that’s simply not enough juice for me. There are corporate bonds paying close to 7% right now and if inflation skyrockets due to tariffs and trade wars, bonds will likely end up paying even higher yields.

I liked the Calamos ETF product and they have other ETFs as well with higher yields such as the recent CPRA (Russel 200) that had a yield of 9.18% but since I’m already invested in IWM on my own, I didn’t want to duplicate that trade.

I am signed up for Calamos weekly ETF and I will keep an eye on opportunities but I’m not too keen on investing in anything until we get this tariff/trade war resolved. I expect a great deal of volatility over the next few months or years and would rather sit in cash and be opportunistic when the right time comes.

Share The Wealth

Are you buying any downside protected capped investment products? Let me know in the comments below.