Cash Management is the process of collecting and managing cash flows. Most people’s primary cash flow comes from their paycheck and for many the process is largely automated. Typically your employer pays you weekly, bi-weekly or perhaps monthly. Your employer produces a ledger that notes hours worked, deductions for taxes, insurance or other items and the final amount paid to you and attached check or direct deposit slip.

Having an employer do the bulk of the work for you is great but it is also leads to being woefully ignorant of managing your own finances. This will become a problem when you have an investment portfolio and you are receiving interest, dividends, rental, income, capital appreciation or other sources or cash flows. But before we get into all of that let me give you some lessons learned about managing your paycheck cash flow.

Lesson 1 – Don’t have ALL of your paycheck go into ONE bank account.

As a general rule, I have my paycheck go onto three different banks with the formula 70, 20, 10. I have 70 percent of my paycheck going into Big Bank Co and this serves as my operating account to pay all my bills. The 20 percent portion of my check goes to a secondary account that holds my emergency cash for unexpected expenses or when my 70% account is running low on cash. The other 10% goes into a credit union and serves as a backup emergency fund. Rationale: Risk Management. Over the years, I have met many individuals who have horror stories about banks freezing, losing, locking or otherwise seizing funds from their customers.

Lesson 2 – Try not to co-mingle your spouse/partner funds into your bank accounts

There are generally two schools of thought when it comes to money and marriage, either bundle all the money together or keep it separate. Early in our marriage, my wife and I had one bank account and all the money we made went into it. Unfortunately, we each assumed that the total amount of money in the account was available so we tended to overspend each money because each of us didn’t know what the other was doing with the money or what bills needed to be paid. Once we both agreed to just have separate bank accounts and who would be responsible for what bills, we reduced the stress and anxiety over money. This has worked well for us now for 25 years but I will concede that we are a two income family and won’t work if only one person is working in the family.

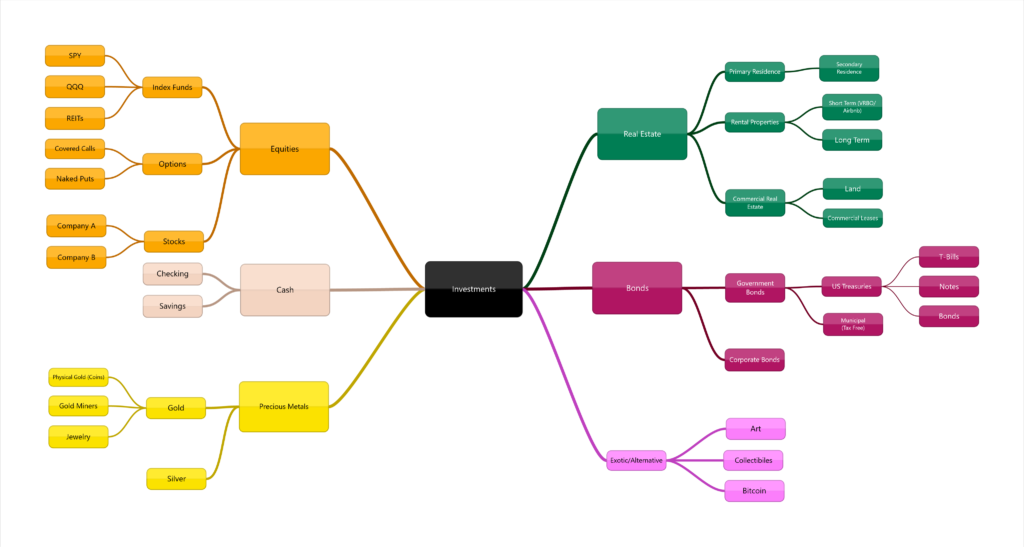

In future posts, I’ll write about managing cash flow for my investment portfolio, each area in the image below has some type and level of cash management that needs to happen on a daily, weekly or monthly basis.