Do you have young kids? If so, you’re probably aware that kids love to play games. My kids favorite when they were young was Monopoly (Ages 8 and up), Settlers of Katan (10 and up) and lately, Secret Hitler (17 and up).

Games & Age Groups

My kids didn’t start playing Monopoly right off the bat, we actually started with games that the kids don’t even remember such as Chutes & Ladders which is intended for ages 4 and up. There were times when we had older kids in our home that wanted to play Monopoly and our young ones left out because they weren’t old enough. The issue for them was that they did not understand the concepts and rules associated with these games, it was “over their head” to play Monopoly at age 4 or 5.

Investing & Age Groups

This brings me to investing and a conversation I was having with one of my kids via email. Since we are in an 8 hour time zone difference, sometimes we need to communicate via email rather than FaceTime so I was surprised when I read an email that was asking about dividends stocks and YOLOing into a particular investment using options.

My response, with no intention of being condescending, was to first being investing in index ETFs such as RSP, SPGP,or HELO for a variety of reasons. I advised him that individual stock picking requires experience in understanding financial statements, CAGR, dividend growth, and a bunch of other variables knowledge that usually comes after about 10+ years of investing experience.

It’s entirely possible to learn all aspects of investing in less than 10 years but that assumes you aggressively study the entire field of investing basically every day and pick up concepts quickly.

I reminded him of the days of frustration when they would try to play Monopoly with the older kids and were out maneuvered at every step of the way. The kids would get angry and frustrated ultimately leading to temper tantrums.

Trying to “play the market” as a 4 year old against 40+ year experienced professionals is just asking for the same anger & frustration outcome. Most professionals can’t even beat the S&P 500 index so the chance that my kids becomes the next Warren Buffett is low unless he focuses 100% of his time on this endeavor which is something I know he is not doing.

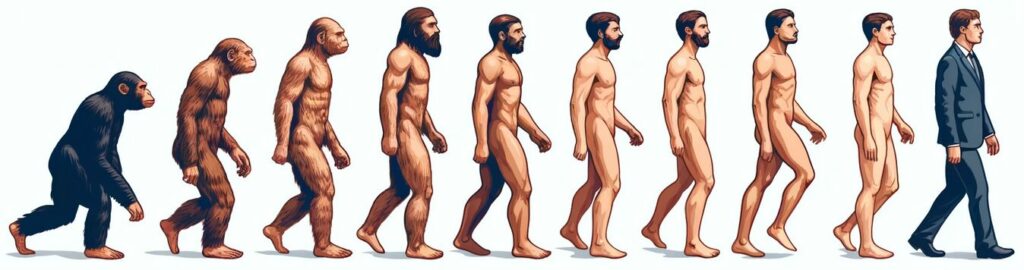

Investing Is An Evolutionary Process

There is a joke about locking 1000 chimps in a room with typewriters and given enough time, they will crank out a work of Shakespeare. It doesn’t really work that way. I am working on a post entitled, “How to Invest In 20’s, 30’s, 40’s and 50’s” but I am reluctant to work on it because it will invariably be wrong as soon as I publish it because everyone’s financial journey is different and unique so I’m not sure if it will be applicable to a broad audience.

Share The Wealth

Did you play games as a kid? If so, how have you used that strategy to invest for real?