The Bureau of Labor Statistics released the Consumer Price Index for April and I was eager to check it to confirm my suspicions about the high cost of meat and electricity. I downloaded the relevant charts and am posting them below. If you want to play around and create your own charts you will find them here.

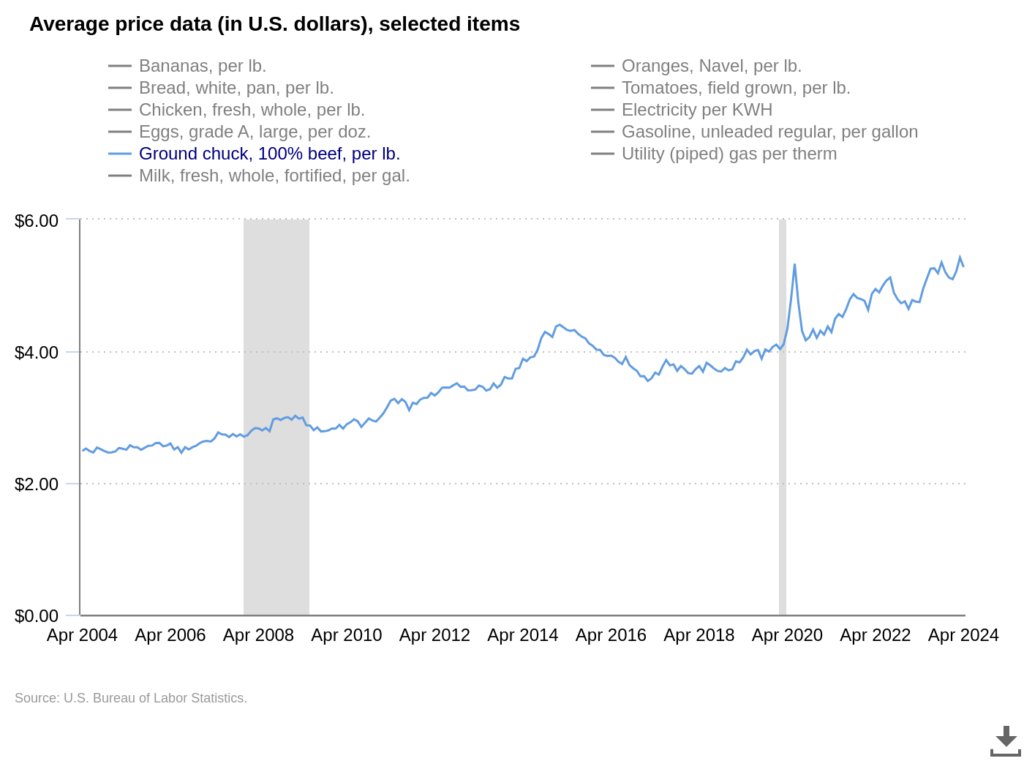

Beef

It’s a good thing that I’m taking Zepbound because otherwise I’d be crying a whole lot more over my grocery bill. and the cost of beef. According to the BLS CPI, beef continues to climb in price. Beef is a large part of the reason why Mother’s Day was so expensive this year.

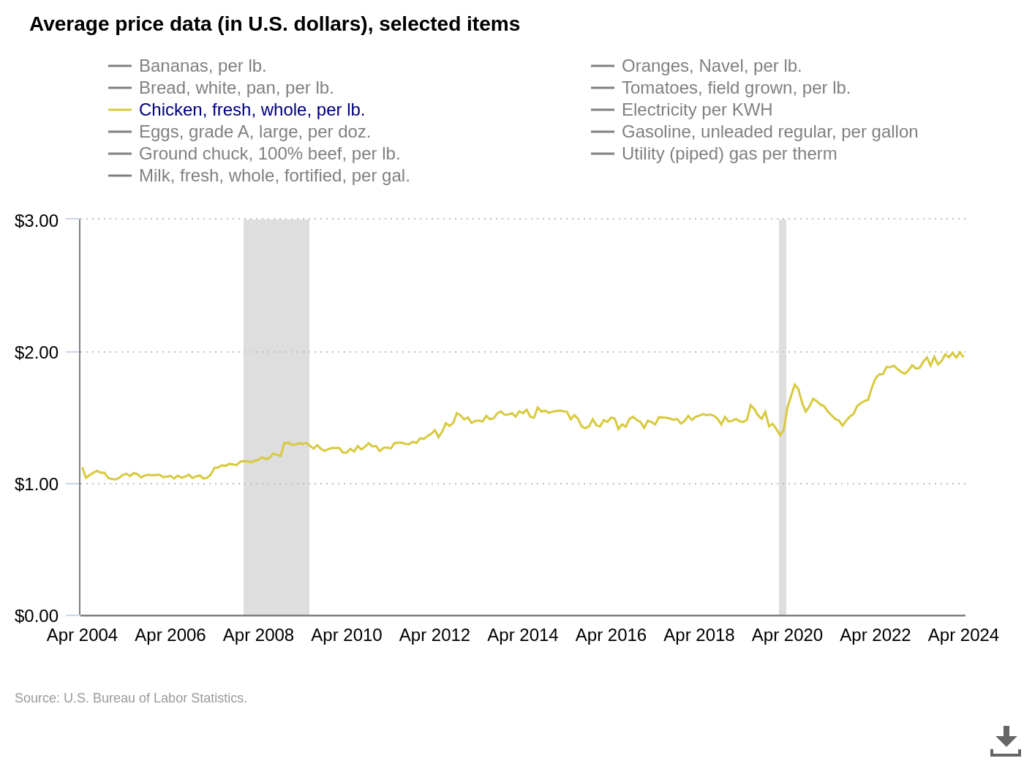

Chicken

Chicken is a bit more reasonable but the price of chicken has still climbed and perhaps because it’s much cheaper than beef the price shock seems more muted yet painful nonetheless.

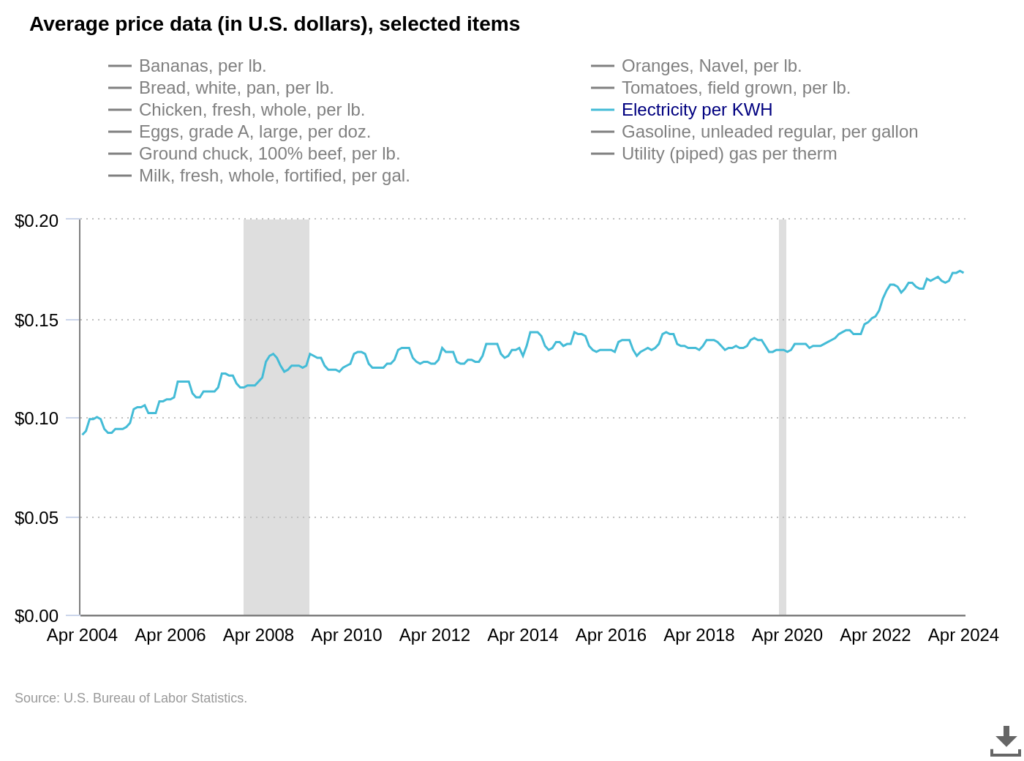

Electricity

I wrote about the cost of electricity not too long ago here and noted the whopping 34 percent increase in electricity cost and this BLS chart confirms my suspicions.

Spend Less Than You Earn?

For the people that are advocates for spending less than you earn, how would you handle this? Eating less beef and chicken is doable but how do you use less electricity? Not turn on the A/C in weltering heat? No thanks!

While I don’t disagree with the premise that people need to live within their means the fundamental problem is that we live in an economic system where the currency (USD) is devalued year after year. If you earned a salary of $100,000 in 2023 and you have 3.4% inflation then you’re purchasing power has automatically dropped to $96,600 without you doing anything wrong. In order to stay even with inflation you would need a 3.4% raise to offset the 3.4% inflation to remain at $100,000 purchasing parity.

Earn More Than You Spend

The key to living beyond ‘surviving’ and into ‘advancing’ is to earn more than you spend, including inflation. The best way to do that is to ask for a raise every year and cite inflation statistics to explain your predicament. The alternative to raises is to have investments that generate income such as stocks, bonds, rental properties, side businesses, gigs, etc.

The charts above show how much inflation has gone up from 2004 thru 2024 and don’t expect that the growth of inflation will stop here. If you extrapolate the next 20 years it’s likely that beef may cost $15/lb or more and I’ve already done my own analysis here even featuring a video from Bush – Everything Zen where I note “a million dollars a steak.”

Share The Wealth

What’s your plan for inflation? Let me know in the comment below if you have one.